Good morning. Happy Wednesday. Happy Fed Day.

Today the Fed the Discount Rate (the rate banks pay to borrow from the Fed) and target the Overnight Rate (the rate banks pay to borrow from each other). It would be a surprise if the rates were moved, so again all attention will be on their statement. If the Fed acts tough, as if they’re getting close to raising rates, the dollar will firm and the market will move down. But if the Fed lets it be known rates will be kept low for the foreseeable future, the dollar could drop, and the market will likely rally.

What the Fed does usually causes a hiccup in the near term but doesn’t often change the trend. We’ll see.

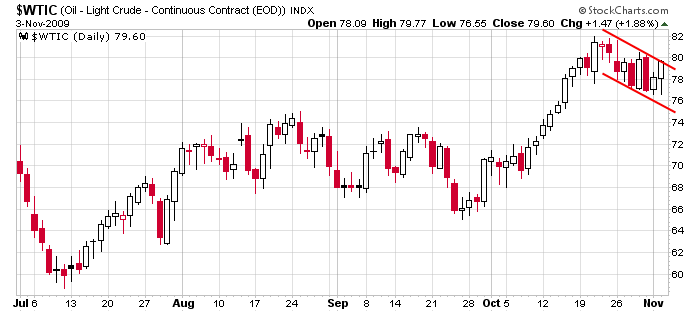

The notable news yesterday was the big move up in gold and the impending breakout from oil Here’s the oil chart. The long ETFs are setting up nicely – they look similar to this chart.

In the case of gold, I wonder if it’s in the process of de-coupling itself from the dollar. There certainly wasn’t anything to justify the big move. In oil’s case, either the economies of the world are expanding or inflation is ticking up again.

The market will be slow until the 2:15 EST announcement. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 4)”

Leave a Reply

You must be logged in to post a comment.

The purchase of almost 8 billion in gold from the IMF by India in order to diversify away from the dollar was the imputus for the move in gold from what I have read. Mike.

Gold I read that the IMF sold gold directly to India. Now people think remainder of gold that IMF plans to sell will go to China. Prior thought was that IMF gold would be sold on the open gold markets and push them down.