Good morning. Happy Friday.

Employment numbers are out…

Nonfarm payrolls dropped 190K and the unemployment rate is now 10.2%.

After the news was released, the futures, which were up slightly ahead of the reports, sold off, but the selling isn’t extremely intense.

To the charts…they are messy…they need to reset.

The market goes through phases of easy money and hard money – right now trades are not obvious; they don’t jump off the screen at me. I personally have no problem laying low for a day or so to allow the market to make the next move because in my view, trading is a big game of follow the leader and I’m certainly not the leader.

There are reasons to be bullish and bearish…something has to give. The good news is earnings season is winding down and the major news events (FOMC, jobs reports) are over. The natural forces of supply and demand should play a great roll going foward.

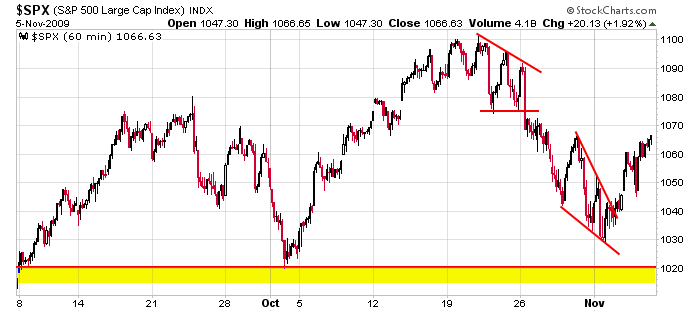

Here’s the SPX 60-min chart. It broke out of a falling wedge and is now smack in the middle of its range.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 6)”

Leave a Reply

You must be logged in to post a comment.

Hope springs eternal ; blah , blah , blah . Maybe Brazil and Australia can sell materials to China , but putting money into the S&P ………. , well , I don’t see it .

Yet , people are doing it , but the employment reports are not so supportive in my opinion .

This is November , is it not ? Calender investing might have a good track record , but it doesn’t always work . Time will tell .