Good morning. Happy Thursday.

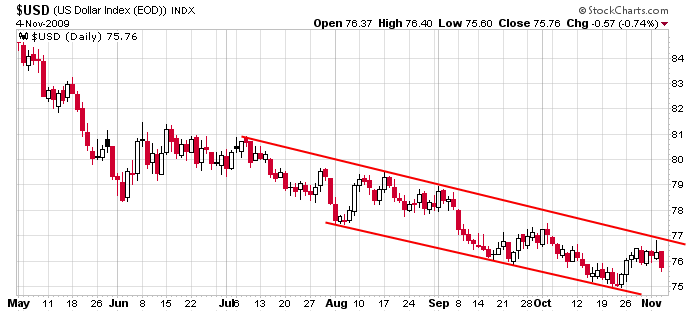

The Fed has spoken. They said economic conditions are improving but the job market along with a negative wealth effect from housing are large hurdles stopping a full-fledged recovery. They also said rates will be kept low for a long time. On this news the dollar dropped. Here’s the chart; it bounced nicely off 75 and help give us some shorts to play, but the overall downtrend remains in place.

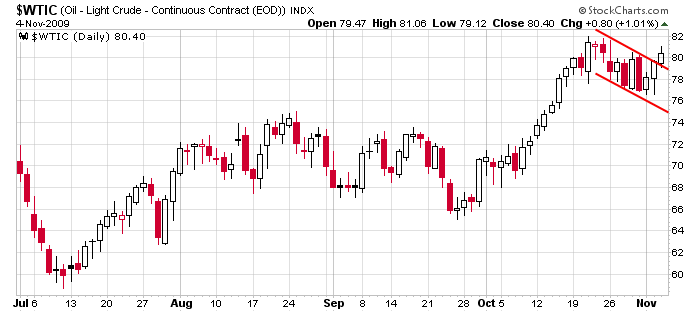

When the dollar drops, commodities tend to do well. Here’s oil. It’s in the process of breaking out.

The Asian/Pacific markets closed mostly down, but losses weren’t great. Europe is down across the board – losses aren’t great there either. Futures here in the States suggests very small gap up open for the cash market.

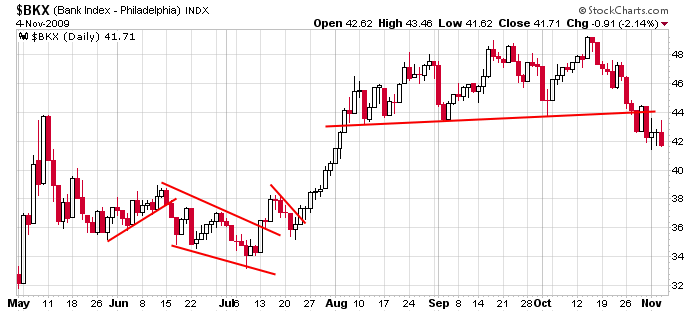

Banks closed at its lowest level since early August. Without them, the market goes nowhere.

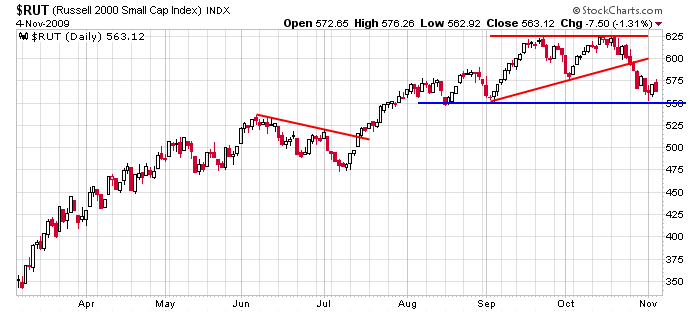

Along with the banks, the movement of the Russell is very important because it tends to lead the market in both directions.

Unemployment numbers come out 60 min before tomorrow’s open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers