Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed without any standout winners or losers. Europe is currently down across the board – there are a couple 1% losers. Futures here in the States suggest a sizable gap down open for the cash market. This comes off a big up Mon and flat, listless trading Tues and Wed.

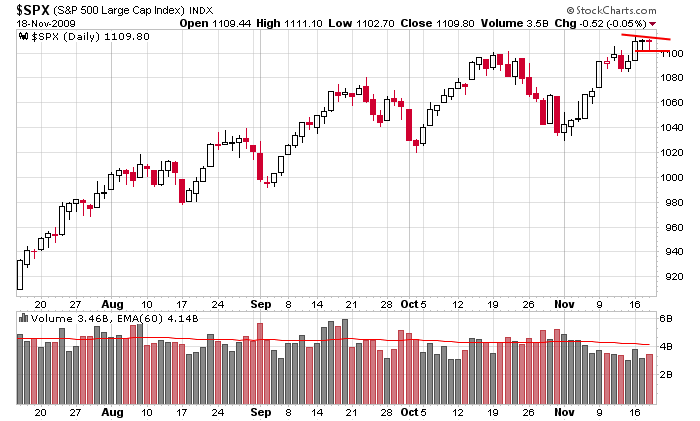

Here’s the daily SPX. The trendlines don’t mean much – they just outline the small range we’ve had the last two days. The trend is up, but today’s open, which will be below yesterday’s low, will shake the tree a little.

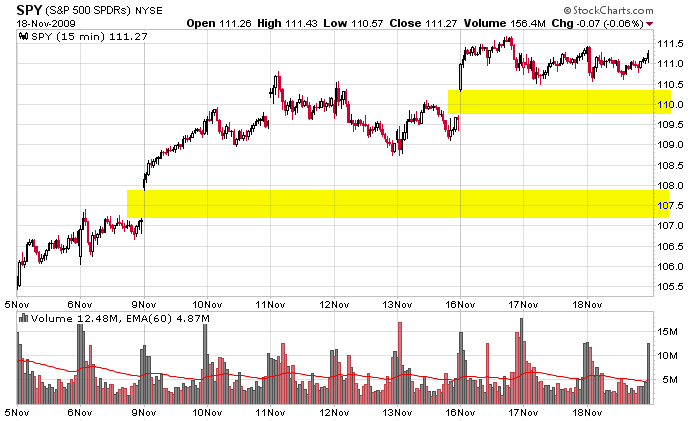

Here’s the 15-min SPY chart. I use it because it shows the gaps better than the SPX. A gap from each of the last two Monday’s remains unfilled below (and there are probably at least 10 other unfilled gaps going back to the March low).

The trend is up, but I can’t say trading has been easy. We’re not getting much follow through on breakouts, and so much of the market’s upside progress is concentrated in a single day here and there, the recent environment hasn’t been conducive to anything but very short term trading.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers