Good morning. Happy Friday. Happy options expiration day.

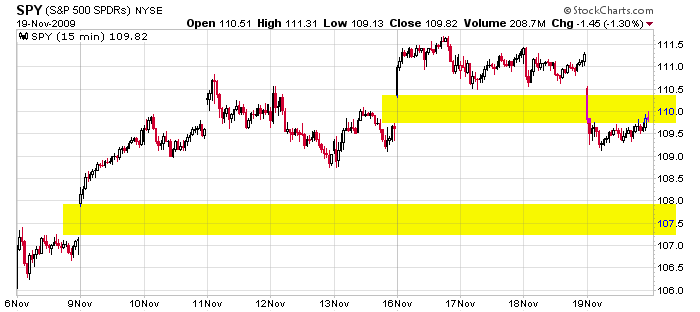

Earlier this week I talked about what the index ETFs needed to do to cause the most pain per the put/call open interest. SPY needed to close above 109 (it’s at 109.82 right now); DIA needed to close around 103 (it’s at 103.65); QQQQ needed to close around 44 (it’s at 43.66); and IWM needed to move into the low 60’s (it’s at 58.66). So the market has done it’s job. SPY and DIA are where they need to be. A handful of QQQQ put buyers might make a very small amount, and only IWM put buyers at very high strikes will make money (there aren’t many relative to all the strikes). Once again the bears bet on a big move down and once again they lost.

The Asian/Pacific markets closed mixed (not bad considering the selling pressure from the States yesterday); Europe is currently down across the board – there are no 1% losers. Futures here in the States suggest another gap down open for the cash market.

Here’s an update of the 15-min SPY chart. Monday’s gap up was easily filled; The Nov 9 gap is about 25 S&P points below yesterday’s close.

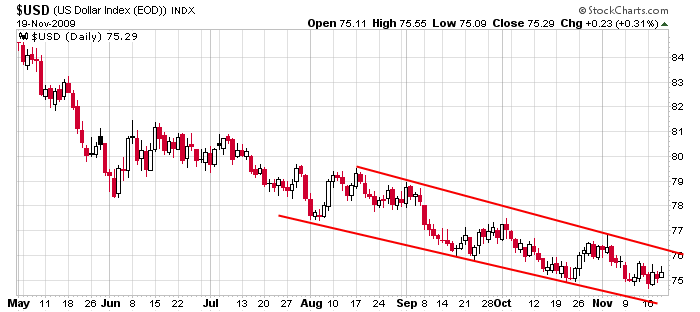

The dollar remains in a downtrend but hasn’t been able to break 75. If it moves up, the market will move down.

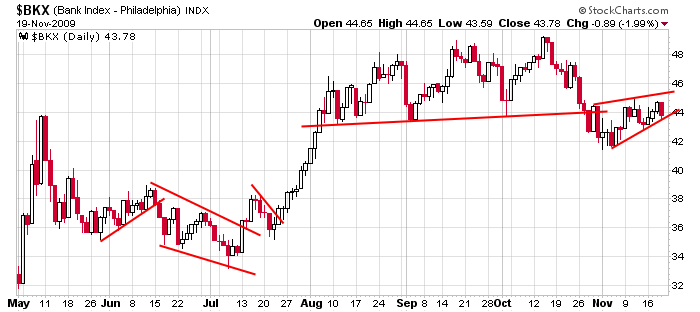

Here’s BKX. It broke down in late Oct and is now trading in a bear wedge. If this chart breaks down, the market will move down too.

Entering this week the trend was up, but there were significant warning signs. After a big Monday that registered new highs, the warnings have exerted their will. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers