Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with a bullish slant. Europe is currently up very nicely across the board. Every market is posting at least a 1% gain. Futures here in the States are up solidly.

The last two Mondays have been big up days. It’s too early to see what today will bring, but so far, so good.

Aside from all the negativity going on and all the reasons the market ‘should’ drop, there are two very bullish items. 1) The Fed won’t let the marekt drop (the Bernanke put) and 2) inflation. Just like inflation causes the price of hot dogs to go up, inflation causes the stock market to go up – even if the real world economy doesn’t support the higher prices.

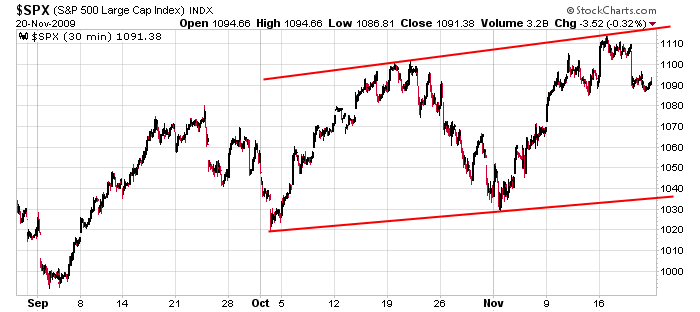

Here’s a 30-min SPX chart of the last 3 months. Higher highs and high lows – the trend is up, but it hasn’t always been easy to trade because instead of pausing after a rally, the market is giving back more than 50% of its gains.

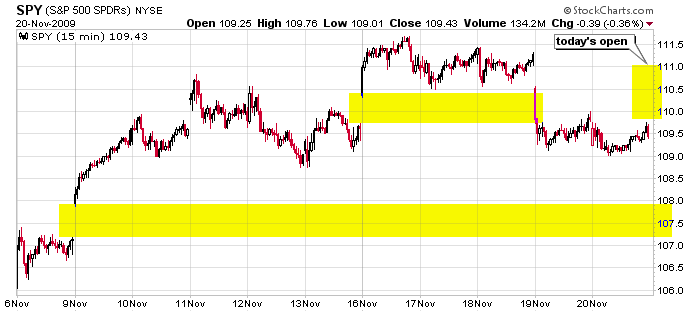

Here’s the 15-min SPY chart. Last Monday’s gap was filled Friday. Today’s gap will be in the upper quarter of last week’s range and not far from the highs.

The longer term trend is up…shorter term trend is flat…lots of gaps…not easy to play lately. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 23)”

Leave a Reply

You must be logged in to post a comment.

Jason,

I would be interested in seeing the correlation between inflation and rising stock prices. We did not have rising stock prices in the 70’s and inflation was terrible. This is probably a tenuous relationship.

Eventually, all these damaging things are going to be viewed by the market for what they are………………damaging. I’m talking about a tanking currency and inflation. But for now, as Robert Earle Keen sings, “The road goes on forever and the party never ends.”

http://www.youtube.com/watch?v=glhrczA1ru4