Good morning. Happy Friday.

By itself, yesterday’s late-day sell-off wasn’t a big deal. The overall trend remains in tact, and the 3-week consolidation period continues. But looking a little deeper, a major warning sign may have been flash – a possible “canary in a coal mine.”

The financials got crushed. They’ve been lagging – I’ve noted it constantly the last several months. How many times have I said: “The trend is up, but the banks and small caps are lagging?”

But despite the lagging, the financials never broke down or traded in a way to negatively influence the rest of the market…until possibly now. In fact last night while looking at charts, I was reminded of the summer of 2007 when all the investment banks suddenly broke down while the overall market remained in good shape. The market rolled over soon after; I wonder if this the same will happen this time. At the very least, keep stops super tight on longs because if the market falls apart, it can fall apart fast.

Here’s $BKX. It traded above horizontal resistance yesterday and immediately got pushed back.

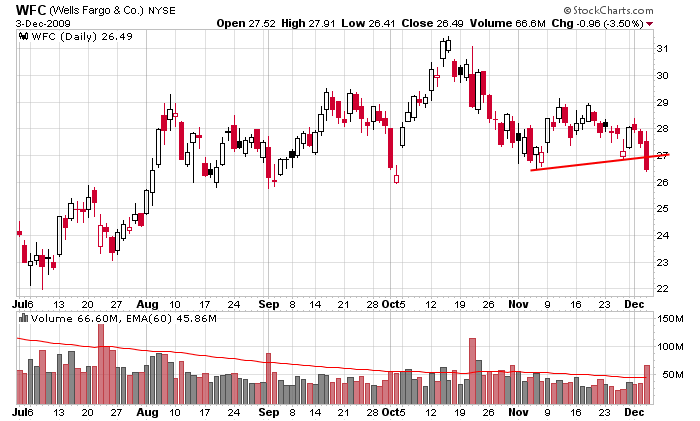

Representing the large banks, here’s WFC. It broke down yesterday on huge volume and has one more decent support level at 26.

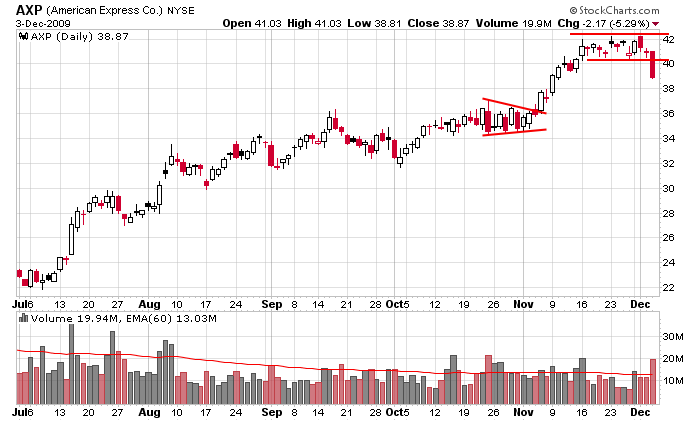

Representing credit, here’s AXP. Big down day on big volume.

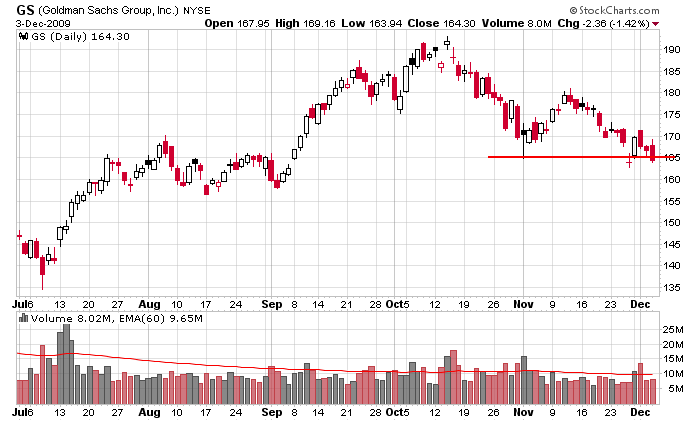

Here’s GS. I’m not sure what they represent, but it’s noteworthy the stock is nowhere near its high at a time the S&P made a new high yesterday. And it closed below support yesterday.

Maybe the weakness was due to Bernanke acting tough yesterday – he wants to get reappointed. Who knows. In any case, we cannot ingore the huge selling pressure from the financial group.

Employment numbers are out…

Unemployment rate is 10.0% (down from 10.2%)

Nonfarm payrolls dropped 11,000

Futures spiked on the news. It’ll be a fun day.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 4)”

Leave a Reply

You must be logged in to post a comment.

It seems to me that the down trend is more likely a result of year end profit taking to offset losses from March sales.