Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – there were a few 1% losers. Europe is currently mixed and without any standouts. Futures here in the States suggest a gap up open for the cash market. No surprise there. Over the last 3+ weeks the market has gapped big 7 times at the open – 4 up and 3 down. Gaps are as common today as they’ve ever been. Lots of emotion out there. The smallest news item doesn’t just induce buying and selling, it induces a lot of it since there are so many players worldwide.

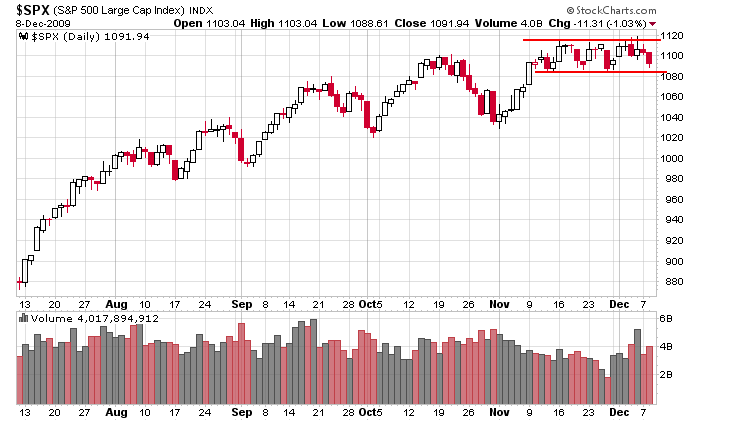

But despite all the gaps and whippy action, the market is largely unchanged over the last month. It’s frustrating when the market sits in a tight range, but in the grand scheme of things, it’s healthy and constructive and necessary. The trend is up, but the market needs a break from time to time to restore its spent energy. Here’s the S&P chart. Nothing wrong here – a consolidation pattern within an uptrend. If it breaks out to the upside, my target is 1200. If it trades below support, I would not expect a crash; there are many levels of support below.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers