Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – there were several 1% losers. Europe is currently down across the board – more than half the indexes are down at least 1%. Futures here in the States suggest a sizable gap down for the cash market (S&P down 9, NDX down 17).

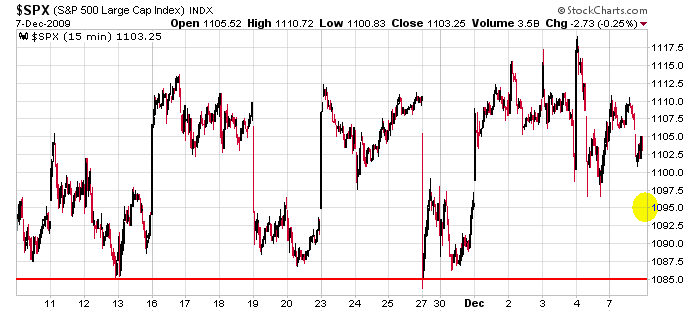

As noted yesterday, the last 4 days have seen the market get bought up early in the day and then give everything back. How many times will the bull support the market only to see their hard work go up in smoke?

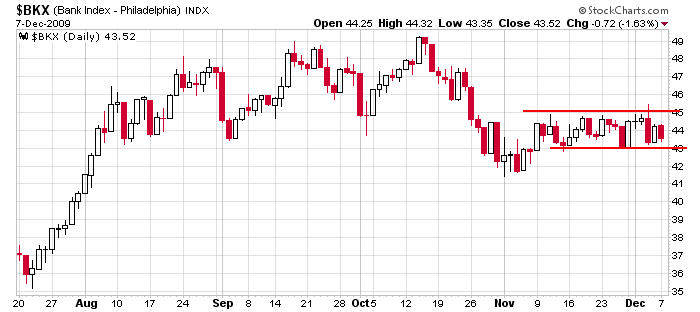

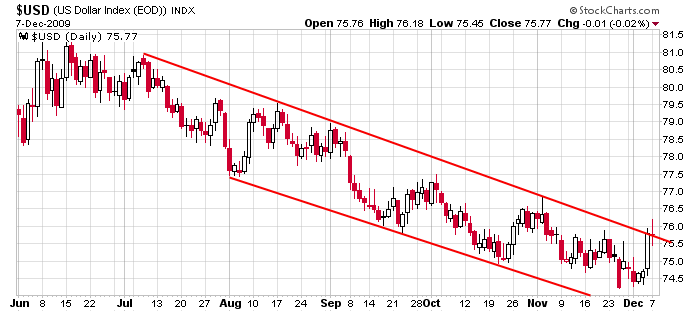

The overall trend remains up, but there are warnings signs. Some signs are more dominant than the others. In my opinion, the dollar and the banking group are more important than any other sector or the strength of the small caps vs. the large caps.

Here’s BKX. If it slices through support, I see almost no chance the market moves up.

Here’s the US dollar. I’d still consider it in a downtrend, but last Friday’s huge up day does get my attention.

Here’s the S&P. It’s a choppy range-bound mess. Until this slop resolves, all trades need to be kept short term because not only are dips getting bought and rallies sold, the gaps can take things from you before the market opens.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers