Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed – China gained almost 2%.

Europe is currently up across the board, but there are no 1% winners.

Futures here in the States suggest a gap up open for the cash market – I’ve lost count of how many S&P gaps of more than 5 points we’ve had in the last month.

This is the last full week of trading this year. The following two weeks are shortened due to Christmas and New Years. This Wednesday is a Fed meeting, so although today should be a normal day (whatever normal is), tomorrow will be slow.

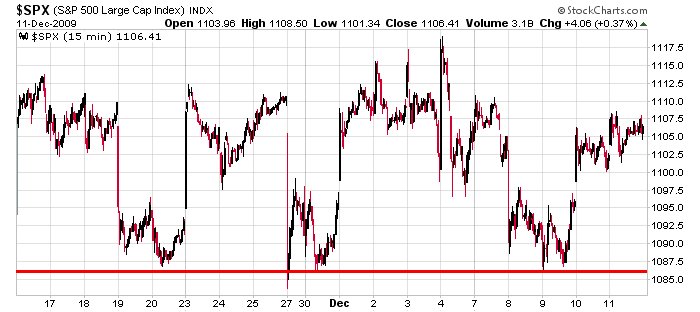

Here’s the 15-min S&P chart heading into this new week. Support was successfully tested last week, and today’s open will be near last Monday’s highs. Once again the bears got excited about a top being in place, and once again they failed to gain any follow through to the downside.

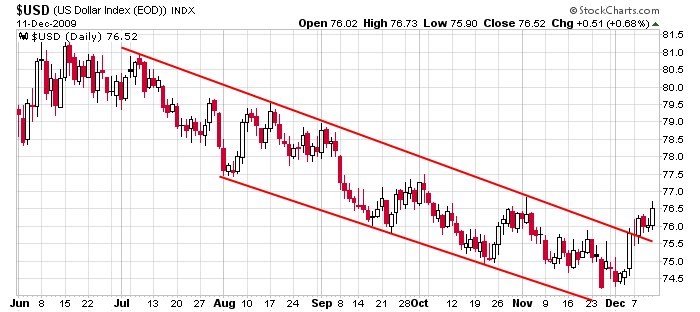

The US dollar has now been in a 2-week uptrend and currently sits at its highest level since late October. I’ve argued the weak dollar was helping the market rally, but so far, a strong dollar has not hurt the market. We’ll find out very soon what the correlation is between the market and the dollar.

I’m keeping trades short term for now. There’s no sense placing big bets while the market is range bound.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers