Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed with a downside bias. Europe is currently mostly down – the losses are minimal. Futures here in the States point towards a down open for the cash market.

This comes off 4 consecutive up days and only a closing basis, a new high for the S&P and other indexes.

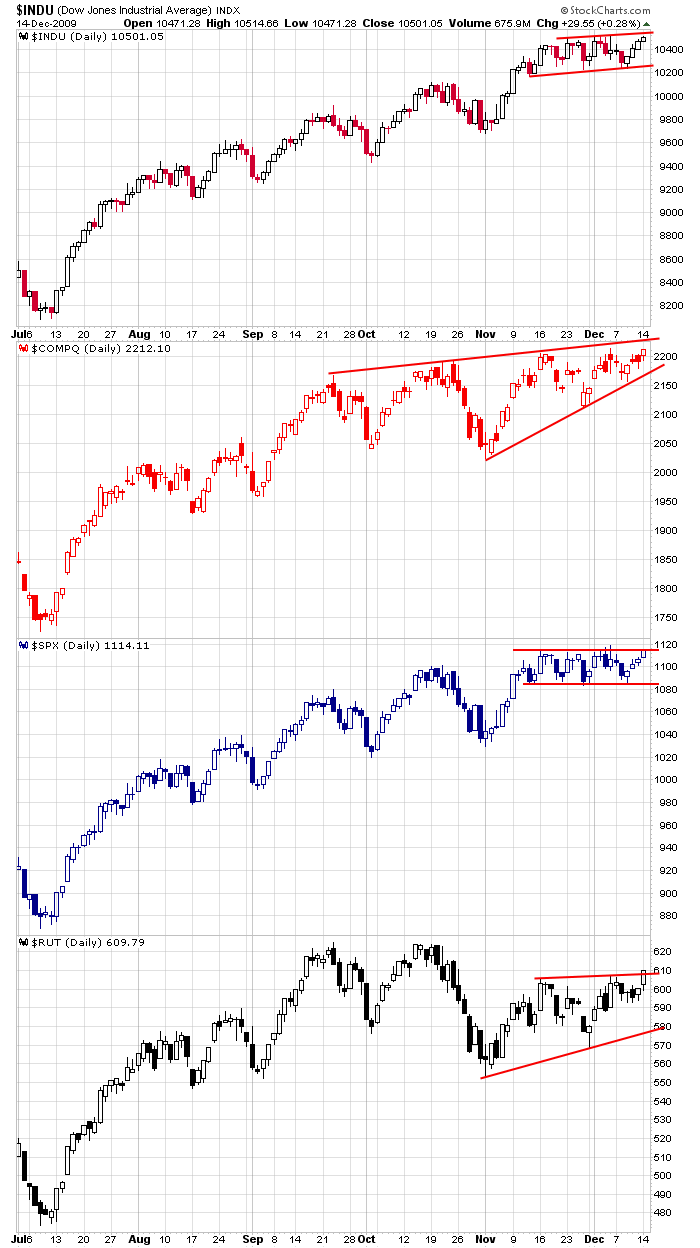

Here are the Dow, Nasdaq, S&P and Russell dailies. For the last 5 weeks dips have been bought and rallies sold. Being that we’re near the highs of the recent range and the FOMC announcement is tomorrow, it probably wouldn’t take much to start the next leg up.

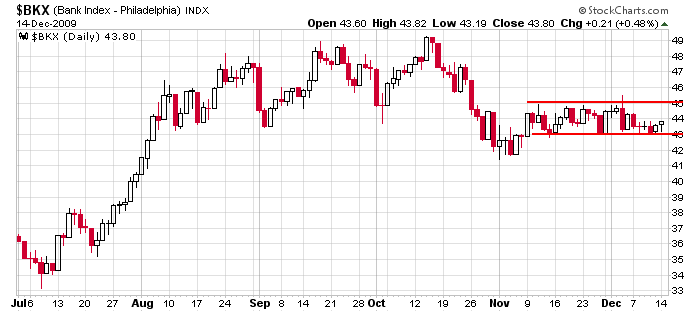

Here is banking group. It’s neutral and lagging the market. This needs to change. Short term anything can happen, but for a move up to last, this chart needs to follow along.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 15)”

Leave a Reply

You must be logged in to post a comment.

Hello Jason,

Have you stopped “Before the Open” emails? I have not recieved one for the past few weeks.

Thanks,

Steve

Hi Steve…the emails keep going out…every day. Not sure what to tell you. Perhaps they’re going to a junk box. If you ever don’t get an email, you can always come directly to the blog here.

Jason

The $BKX has dropped below support today. What is your opinion of its significance?

Yes it did.

There are lots of items pulling the market in different directions. The small caps and semis have been strong lately (good for the market)…the banks have been weak and the dollar strong (both bad for the market). Who’s going to win? I don’t know. I do know the trend is up, so my bias remains to the upside. The market can rally without the banks in the near term, but I doubt we get an extended rally without their participation.