Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down – China and Hong Kong dropped more than 1%. Europe is down across the board – only London is down more than 1%. Futures here in the States point towards a fairly large gap down for the cash market.

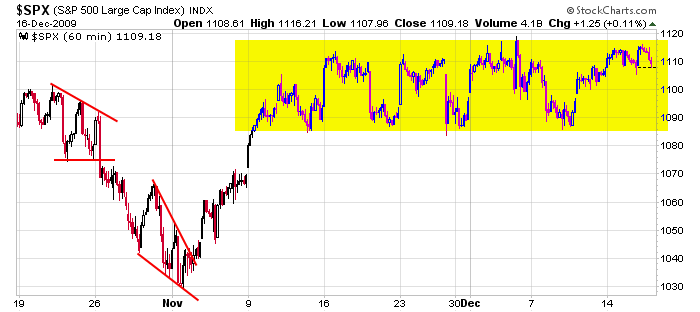

For the last 6 weeks dips have been bought and rallies sold. Given the indexes were at or near the tops of their ranges, a pullback simply continues the pattern. Here’s the 60-min SPX chart. We’ve had some very good trades, but our holding times have had to be kept shorter than we’d like. Ideally we’d hold for a couple weeks to allow the charts to fully play out, but when you’re stuck in a range, we have to be ahead of the curve taking profits – otherwise, in many cases, they dissappear.

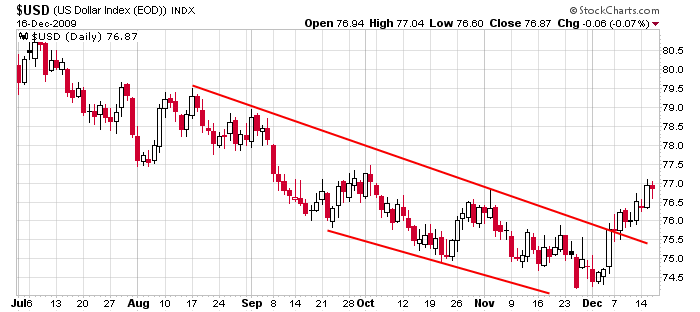

The movement of the dollar is being blamed for the futures market being down so much. From a trading perspective, it doesn’t matter why something is happening, it only matters what is happening. The dollar’s movement is worth noting, but I wouldn’t trust the media’s analysis because they desperately search for reason that don’t exist. Right now, the dollar is trading above th early Oct high.

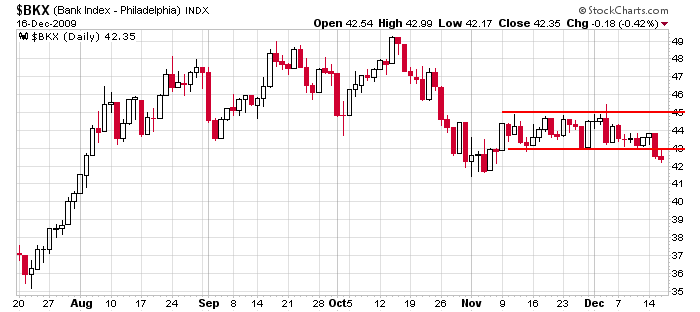

I can’t not mention the banks. They’ve been weak lately while the small caps and semiconductors have out-performed. This divergence can last in the short term, but it can’t last long. The banks don’t need to lead, but they do need to keep up.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers