Good morning. Happy Wednesday. Happy Fed Day.

Today’s the day the Fed targets interest rates which help determine how aggressive banks are with their lending. Rates are already practically zero, so they can’t go any lower, and given the unemployment situation and weak housing market, rates will not be raised. But for the for the first time since the economy slipped into a recession, the unemployment rate has ticked in a favorable direction. Sudden Wall Streeters have to contemplate the punch bowl being taken away sooner rather than later. This is what everyone will be listening for in the statement. Will there be hints the Fed can be less accommodating?

The Asian/Pacific markets closed mixed. Europe is currently up across the board. Futures here in the States point towards a moderate gap up open for the cash market.

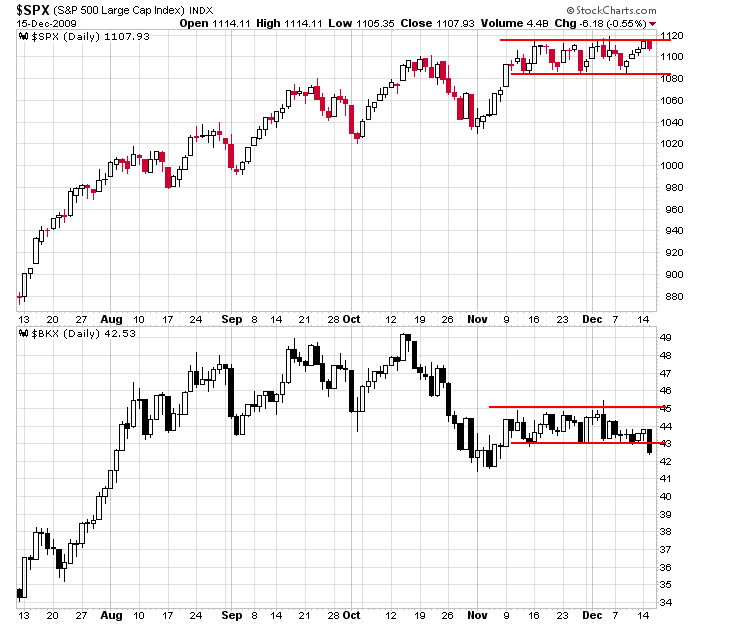

Yesterday the indexes traded up to the tops of their ranges while the banks broke support. This divergence can continue in the short run, but over time there’s no way the market can rally without the banks (or can it – I’ll talk about it after the close today). Here’s the S&P and BKX.

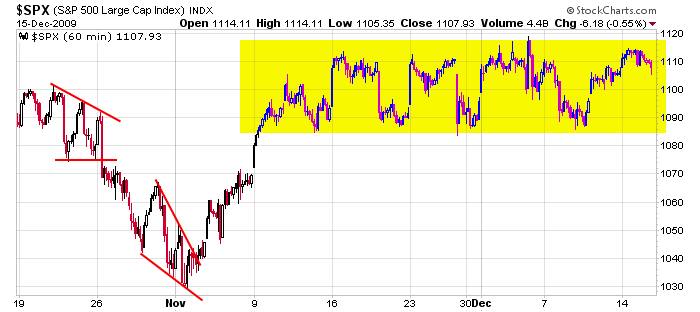

Here’s the 60-min SPX. We’ve had more than 5 weeks of range bound trading. Individual stocks are breaking out and offering some decent profits, but until this range resolves, we have to be content with 5-15% gains instead of 20% or more.

The Fed does their thing at 2:15 EST. Expect lots of volatility, and remember, the market tends to reverse its post Fed move the next day. I’d love a sell-off today and then a rally tomorrow. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers