Good morning. Happy Monday. Happy New Year.

At this time last year, everyone thought the world was coming to an end…well at least the financial world. And here we still are. The financial world didn’t just survive, it thrived – albeit with a huge bailout and backstop from the government. The Dow moved up 19%, the S&P 23%, the Nasdaq 43% and the Russell 25%. These are much more impressive than the historical gains the market registers on average.

I too was surprised by the extent of last year’s rally, but luckily I don’t trade what I think will happen, I trade what is happening. When the market bottomed in March, I went long, and other than a couple short instances where I turned neutral, I was bullish the last 9 months. I learned long ago I’m not smart enough to figure out what will happen next, so I just go with trend. If the trend is up, even if it doesn’t make any sense, I play the long side. Why make things harder than that? If you want to guess and predict and put your foot down and demand the market do what you want, good luck. That’s not my game.

The Asian/Pacific markets closed mostly up. Europe is currently up across the board. Futures here in the States suggest a moderate gap up open for the cash market.

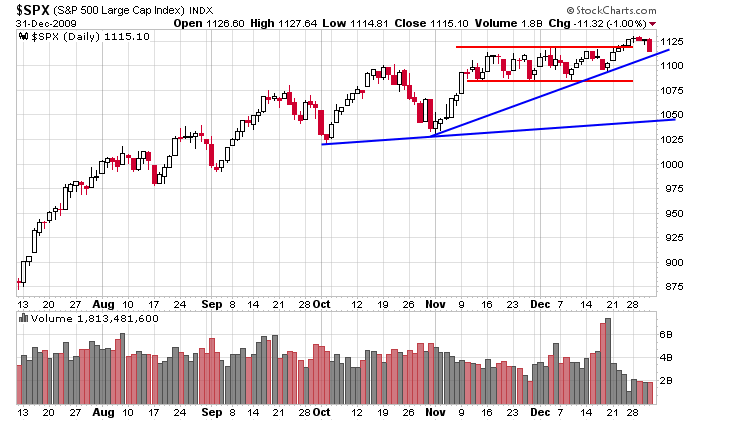

Here’s the SPX daily. The index traded above its 6-week consolidation pattern, but volume was light and energy and momentum was nonexistent.

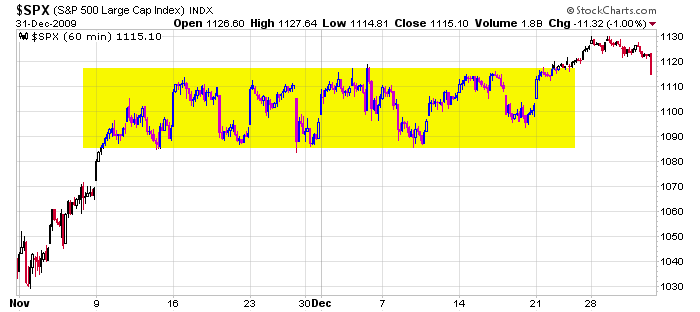

Here’s the 60-min SPX which highlights the tight pattern and attempted breakout. The index is back within its range.

The trend remains up, but the momentum and life isn’t strong. I’m suspect and being conservative. We’ve had many stocks bust out and rally to their targets. The charts may need to reset.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers