Good morning. Happy Wednesday.

2010 has started off on a good note. A big up day Monday on so-so volume was followed by a small up day on bigger volume yesterday. The trend remains solidly up, but the action isn’t screaming bullish. Instead of breaking out, the indexes seem to be grinding and drifting up. But a gain is a gain and those who believe the beginning of Jan is a good predictor of the rest of the year are getting excited. I don’t entirely buy such stats because as I stated yesterday, if you’re going to enter a trade for statistical reasons, you have to be committed to executing the trading dozens of times for the law of large numbers play in your favor. This would entail going long or short at the beginning of every year for the next 20…a commitment I’m not willing to make.

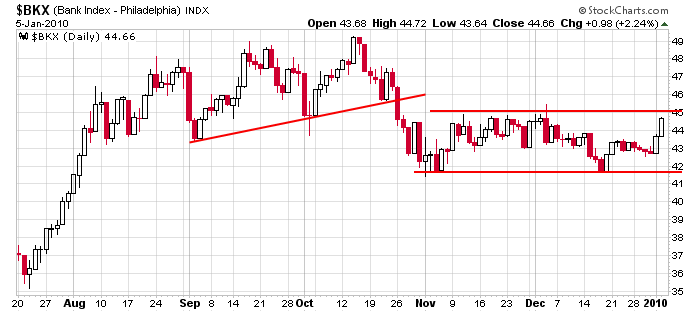

Banks, which have been lagging, have played catch up the last two days. Here’s the daily chart. Stiff resistance is just overhead at 45, and things don’t get much easier between 45 & 49.

Otherwise there’s not much extremely important Wall St. news to discuss. The big news overnight came from the political world where several sitting Dems decided to not seek re-election…one of them being Chris Dodd, Chairman of the Senate Banking Committee.

I sense a little complacency coming into the market. Don’t get lazy out there.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers

0 thoughts on “Before the Open (Jan 6)”

Leave a Reply

You must be logged in to post a comment.

It is hard to be bearish here but at the same time it is hard to be really bullish. From looking at the charts and data it seems like a move is coming. My guess is that we get a 2 to 5 percent pull back and then a nice 10 to 15 percent bull run.