Good morning. Happy Thursday.

The Asian/Pacific markets closed down; Europe is currently mostly down. Futures here in the States suggest a gap down open for the cash market.

The market has been up 10 of the last 12 days, and other than very brief end-of-day selling on Dec 31, there hasn’t been much selling pressure. It’s been the Energizer Bunny market…it keeps going and going.

Most of the volume in today’s market is computer algorithms operating on autopilot. It seems when one gives a buy signal, many follow, so the moves keep going without correcting much. That’s one reason we’ve had so many “forward 10, back 8” moves instead of the customary “forward 3, back 2.”

Tomorrow, the latest employment numbers will be released. The unemployment rate is supposedly at 10%. The numbers again are a catch-22. Good numbers suggest improved economic conditions, but this many carry higher rates sooner rather than later. Poor numbers tell us the opposite and that rates will likely be kept low for a long time. What does Wall St. prefer…an improving economy and higher rates or a sluggish economy and lower rates?

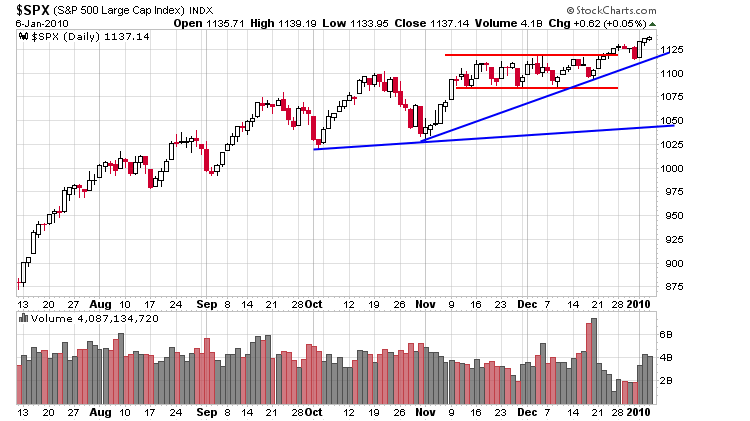

Here’s the daily SPX. The market is grinding higher rather than forcefully moving up. A quick move in either direction can materialize any time.

The trend is up, so that’s that direction I’m playing, but with so many stocks hitting their targets recently, I’m getting more conservative here. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers