Good morning. Happy Wednesday.

The Asian/Pacific markets closed down – China lost more than 3%. Europe is currently mixed and without any big movers. Futures here in the States suggest a positive open for the cash market.

The S&P 500 broke its 6-day winning streak yesterday with a 1% drop – no big deal and not a surprise.

I’m going to say it one more time…be shorter term oriented or longer term oriented. Don’t get caught in the middle of you’re likely to get stopped out at exactly the wrong time.

The charts need to reset. The indexes have been on a nice run since mid December without taking a break. Dozens of our stock picks have broken out and rallied to their targets, but now a little time is needed for them to rest, restore their energy and get ready for the next move.

Maybe the market bottoms soon and moves up, who knows? That’s not something I can predict. I can however assess the risk/reward of new trades and come to the conclusion it isn’t as favorable now as it has been.

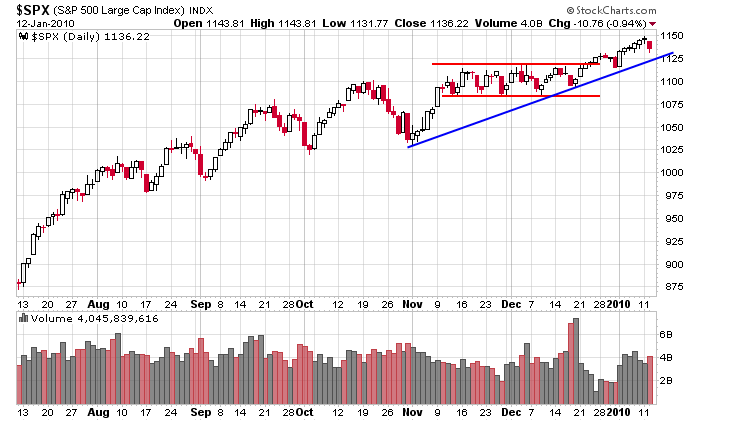

Here’s the S&P daily – nothing wrong with this picture, and there are many layers of support below the current level.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers

0 thoughts on “Before the Open (Jan 13)”

Leave a Reply

You must be logged in to post a comment.

Jason,

Thanks for the insight. I have a basic question, “how do you assess risk/reward?”

I am not good at doing this and could use yor help.

Thanks,

Steve

Steve…risk/reward has to do with how much I can realistically make vs. how much I have to risk to maintain a position. If the upside is only 1-2 points while the most logical stop is 1 point away, the risk/reward isn’t great. But if the upside is 5 points, and you only need to risk 1, then you have a favorable situation.

This said, you’re not always going to hold until the target or stop is hit. If the overall market turns, you’re probably gonna get out sooner rather than later.

Jason,

I realize your site is more oriented toward shorter term traders. Can a longer term trader benefit from your site? I hear “buy and hold is dead”, but it seems like there are trends that last for months, at least. Is TA still effective at capturing those runs?

Hi Ron…Leavitt Brothers isn’t necessarily focused on short term trading. If you look at our archives, you’ll see many stocks every month that are held for several weeks.

Most of our set ups are meant to be held, and then we adjust our holding time based on the market conditions.

All memberships come with a 2-week free trial, so instead of giving you a sales pitch, I’d rather you sign up and see for yourself if we can be a benefit to you. If not, just cancel and you won’t be billed.