When the internet became mainstream, the newspaper industry was near the top of everyone’s “going to die” list. From a business perspective, the economics were too good to be true. Instead of printing and distributing millions of physical papers, one copy could be posted on the internet for all to read. Only a little server space was needed. Instead of waiting until the morning to read yesterday’s news, articles could be written and posted as events were playing out and breaking news could be released as it happened. From a consumer standpoint, the migration to the internet was inevitable. Why wait for the morning paper to be delivered when you’re already caught up on the day’s events from the internet? And besides, the internet allowed for easier direct access to journalists.

But ad revenue online has been significantly lower than in print. The question wasn’t whether the internet was going to kill the newspaper print industry; it was only a matter of when. And if you owned a newspaper, you had one of three choices: 1) Successfully transition to the web and figure out a new business model, 2) Become a multimedia company, where losses from the print business could be absorbed by the other business units, or 3) Write your obituary.

When there’s a big shake up in an industry, there’s typical many years of trial and error and experimenting before anyone figures out what will work in the new domain. And when the dust settles, it’s never one of the old school players that finds the answer – or at least a very good answer. Instead, it’s always a handful of entrepreneurs that create a completely new way of doing business. This time has been no different.

All newspapers tried #1 above, but none have succeeded. At best they still struggle with lower ad revenues and the decentralization of power. For those that didn’t die trying, #2 has been their only hope. None of the major players today would be considered pure newspaper companies. Collectively they own TV and radio stations, hundreds of websites and even test preparation services. Perhaps these conglomerates are just buying time until they figure out how to deal with the changing landscape; or maybe they’ll be rescued by a device such as Amazon’s Kindle? We’ll see; the answer is typically only obvious after the fact.

As the industry changes, there’s lots of speculation regarding its future, and speculation means price movement of the newspaper stocks. Let’s check out the charts of the stocks to see if there are any trading opportunities.

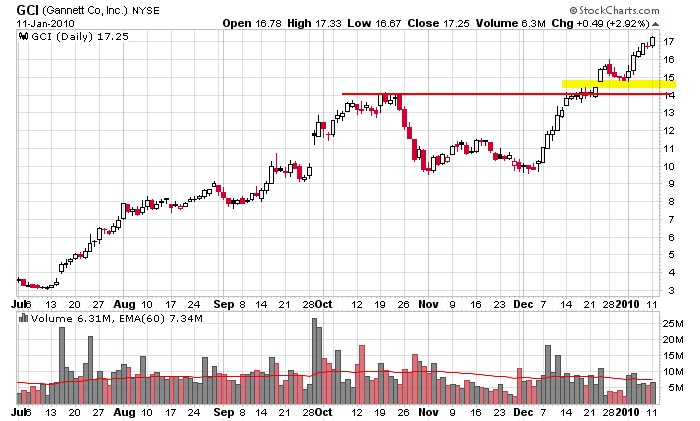

Gannet (GCI): The stock has rallied 8-fold since its March low but is still well off its all-time high near 90. With its steady uptrend and 52-week high in place, the only side to be on is the long side. But considering the near-term run (19 of 24 up days), it’s too far gone to chase. If you’re in, great. If not, a pullback which tests recent resistance at 14 and fills the mid-December gap up presents a decent risk/reward trade – assuming the overall market cooperates.

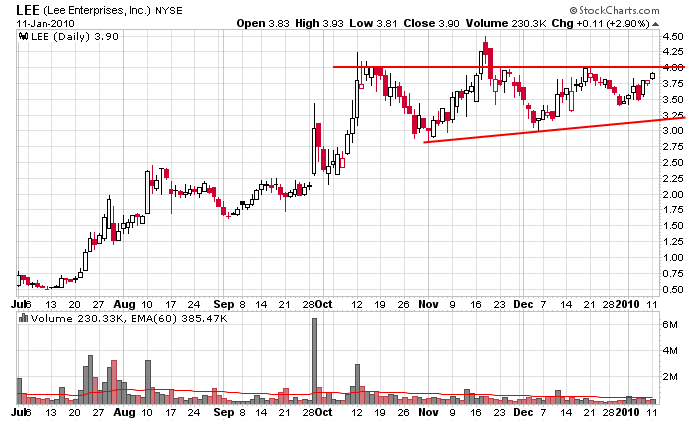

Lee (LEE): Of the bunch, LEE is lagging. It’s the only one that hasn’t broken out and rallied recently. To an amateur trader, this is enticing, but to a pro, getting in a laggard toward the end of a leg up is not a great risk/reward proposition. Everything about this chart looks good, but you’re better off waiting for pullback to the bottom of the pattern than chasing a breakout.

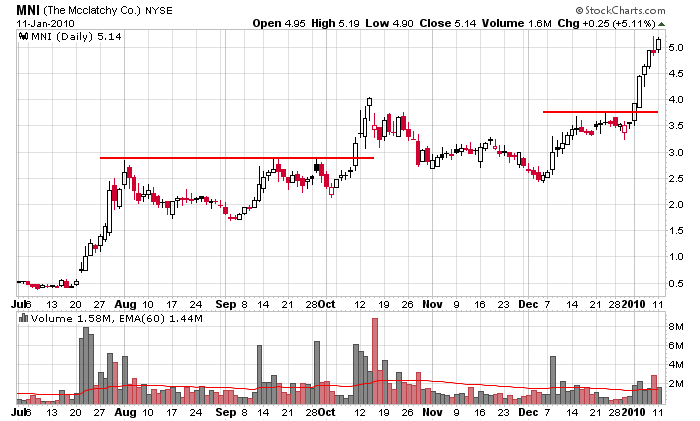

McClatchy (MNI): Peter Lynch would call this a 10-bagger – the stock has enjoyed a 10x return since last summer – a great run but still well off its high in the mid 70’s. It’s too far gone to chase right now, but a pullback which tests the recent breakout at 3.75 while the overall market supports more upside would present a good entry.

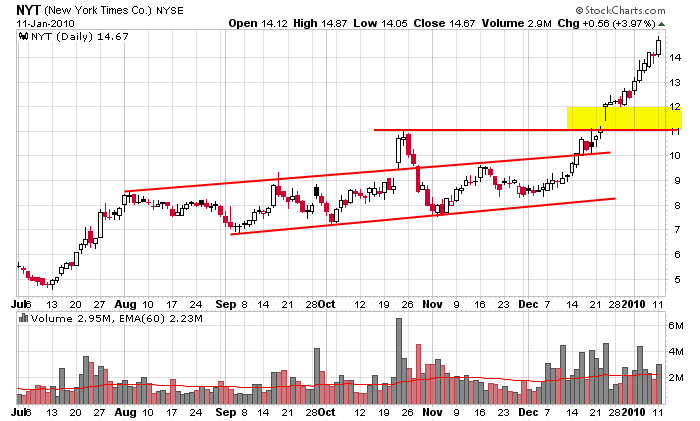

New York Times (NYT): The stock was steadily grinding up through the fall season until mid December hit and the stock went parabolic. It’s done great to recover off its lows near 4 bucks but is still well off its high in the low 50’s. Like the other large cap stocks here, it’s too far gone to chase. A pullback is needed to get a better risk/reward entry.

Overall, these stocks are in bad shape considering how far they’re off their highs, but over the last 10 months, they’ve done great. They’re trending up, and as long as the overall market doesn’t fall apart, they’re buyable on dips.