Good morning. Happy Thursday.

Heading into this week I did a quick piece on what the market would have to do if indeed it was to conspire to cause the most pain among option traders. The conclusion was a flat market would do the trick. What has happened? Yep, a flat market. SPY is up 0.05 on the week…DIA is up 0.64…QQQQ is down 0.20…IWM is down 0.14. All of these are less than 0.50% moves. I don’t trade off the stats (i.e. I would never hold a position assuming the market will act a certain way), but I do like to keep them in the back of my mind.

Moving on, the Asian/Pacific markets closed mostly up; Europe is currently mixed with a bullish bias; futures here in the States suggest a positive open for the cash market.

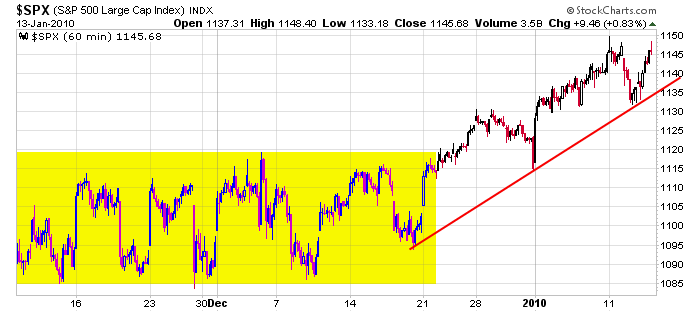

Here’s the SPX 60-min chart. Other than the last trading day of 2009 and this past Tuesday, the index has been steadily grinding up. My bias continues to be to the long side…although given this bias I shift back and forth between being aggressive and being conservative.

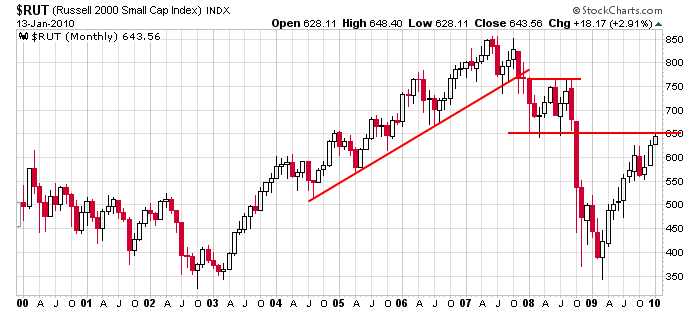

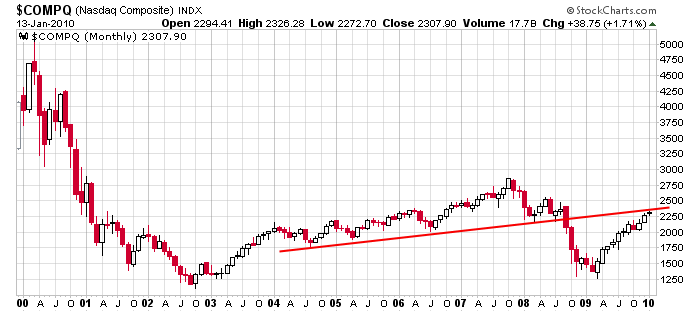

Two charts that continue to jump out at me are the monthly Russell and monthly Nasdaq. Each are up against what could be considered long term resistance. Here they are:

Heading into this week I thought the charts needed a break, they needed to reset. I was able to find a couple good set ups which were added to the Long List yesterday, but I’d like more flat trading before attempting another leg up. We don’t get to dictate what happen, but that is nevertheless what I want.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers