Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Europe is down across the board. Futures here in the States suggest a moderate gap down open for the cash market.

INTC did pretty well with early yesterday…the stock is trading flat right now.

No surprise JPM’s profit surged…the stock is down 1.4% before the open.

Heading into this week we needed flat trading to cause the most pain among option traders, and that’s exactly what has happened. The indexes have moved less than 1% from last Friday’s close, so once again most of the put/call open-interest will close worthless today.

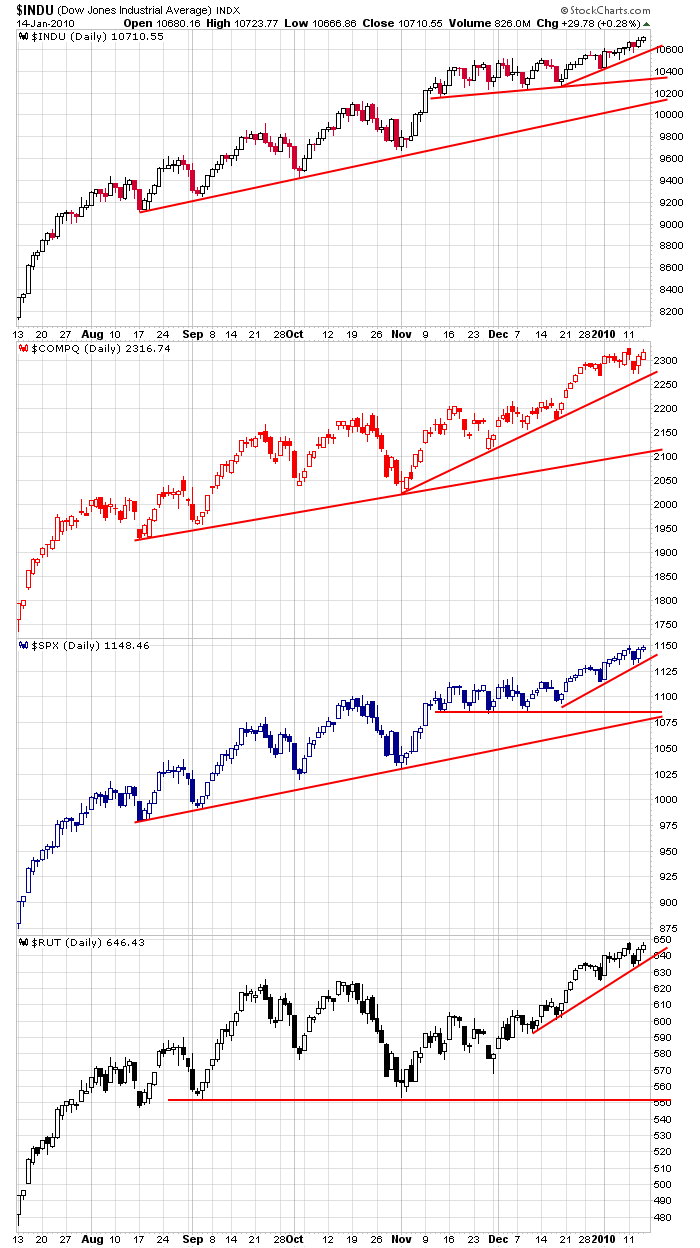

Here are the daily charts. Since I trade in the direction of the trends and make no attempt to guess turning points, I see no reason to be anything but long right now. Sooner or later the market will roll over and give something back…who knows maybe when it happens a top will be in place. When it happens, it happens. I’d rather slightly miss the top than incorrectly guess the top 15 times as so many have done the last 10 months.

The market is closed Monday for MLK Day. More after the Open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers

0 thoughts on “Before the Open (Jan 15)”

Leave a Reply

You must be logged in to post a comment.

I really like your to the point commentary without frills. When Schwab does what you do, they use 5 times as many words.