Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across the board – several indexes lost more than 2%. Europe is currently mostly down, but losses are minimal. Futures here in the States suggest a weakish open, but nowhere near as bad as where the futures were trading last night.

It looks like AAPL will buck the earnings trend. They had a great quarter, and the stock is set to gap up 4 bucks today. This is a relatively small move, especially considering how hard the stock fell last week, but it’s better than nothing. Most companies that have done well with earnings have either gapped down and sold off or gapped up and gave everything back. We’ll see how AAPL does when the market opens.

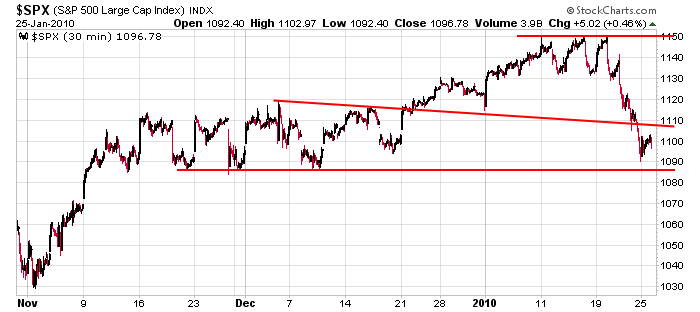

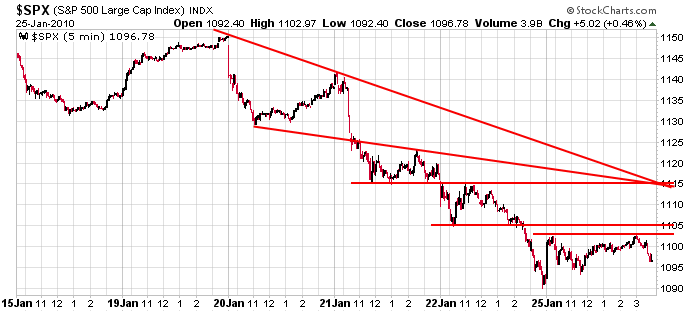

I’d still consider the long term trend to be up and the short term trend to be down, but as noted in yesterday’s report, there are some short term breadth indicators which suggest an oversold situation is already present – a situation that has produced several bounces the last 10 months. If the market bounces soon, it’s business as usual. If the market doesn’t bounce, we have to consider the possibility the character of the market is changing as evidenced by the market not doing what it has typically done is such situations.

Here are the 30-min and 5-min SPX charts with some trendlines I consider significant or somewhat significant. On the downside, the bottom of the late-Nov, early-Dec consolidation period is a potential support level to watch. On the upside, 1115 is a confluence of several trendlines.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers