Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed down across the board – there were several 1% losers. Europe is currently mixed. Futures here in the States suggest a flat open for the cash market.

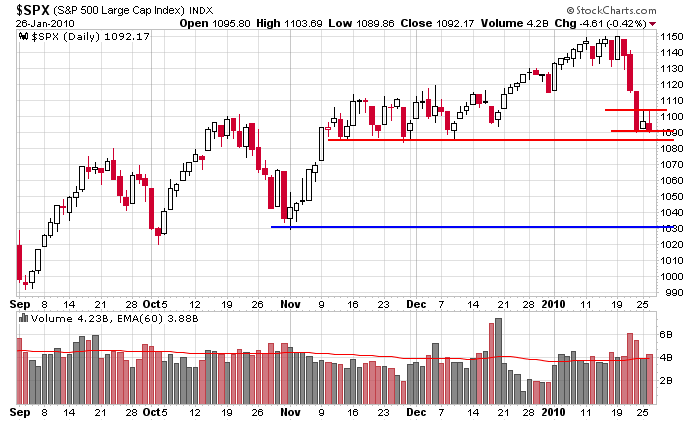

Until the last hour of trading yesterday, things didn’t look too bad. A 2-day range was forming, so whatever extreme negativity exited from last week had somewhat subsided. But the last hour saw intense selling, and instead of closing in the upper half of the mini range, the market closed near its lows. Instead of a mini base forming, it looks more like a bearish continuation pattern is forming.

Here’s the daily SPX. If the little pattern is forming at the midpoint of a larger move, the next leg measures, coincidentally, to the Nov low near 1030.

Today is Fed Day. They’ve made it clear rates will remain low for a long time, so no change in their bias is expected. It should be business as usual…even though Bernanke may be feeling some heat regarding a second term.

Like last time, if the Fed hints the economy is in recovery mode and rates came come up, the market probably won’t like it much, but if their attitude remains unchanged, the market could breath a small sigh of relief.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 27)”

Leave a Reply

You must be logged in to post a comment.

Hola,

Interesante, yo cotizaciуn en mi sitio mбs tarde.

Garretot