Good morning. Happy Friday.

It’s been a heck of a week. As of Monday’s open, the long term trends remained up but short term sentiment was down, and there was a definite lack of good set ups to trade. Four trading days later, the market has made several lower highs and lower lows on the intraday charts, but as of 30 minutes before yesterday’s close, the indexes were mostly unchanged for the week. Lots of up and down movement, lots of spit swapping, and in the end, we were back where we started. Selling then intensified into the close. Still, the S&P is only down 7 for the week, and it’s set to gap up this morning. A moderate up day will close the week positive – a heck of an accomplishment considering sentiment heading in.

This has been a tough market to trade. The charts are messy, and I don’t think the next move is obvious. There have been several times it looked like the bears would finally take over, but the bulls stepped up each time to defend their turf.

There is lots of conflicting data which I’ll cover this weekend. For now, I see no reason to be super aggressive in either direction…although if I had to pick a short term bias, it’d be to the downside.

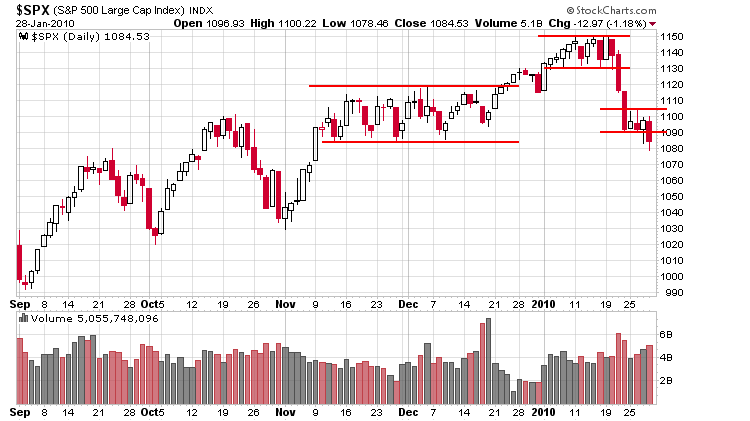

Here’s the SPX daily. Down days carry more volume than up days. If we get follow through to the downside today, the bulls will have one more day to rescue the situation. Otherwise it could be a quick trip to 1030.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 29)”

Leave a Reply

You must be logged in to post a comment.

Jason,

I have been whipsawed all week in my trades. I look forward to getting your overview this weekend.

Steve

A, “lower high”? That just struck my funny bone this morning. A dom lowering her voice to say, “Hi”. Now that’s a, “Lower Hi” Jason.

Sorry, I get bored when I don’t trade.

A “Lower Hi” is a whisper.