Good morning. Happy Monday. Hope you had a nice weekend.

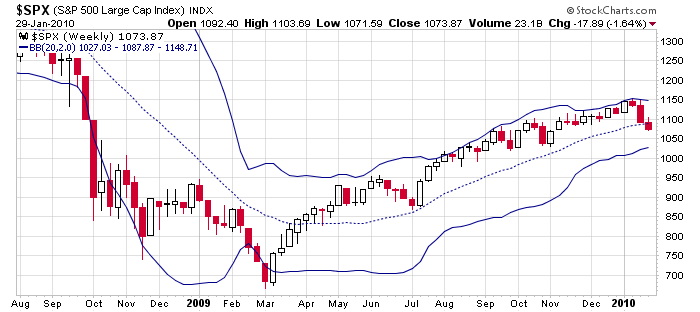

Last week, the S&P experienced numerous 10 point swings in route to registering numerous lower highs and lower lows. As of an hour before Thursday’s close, the index was up for the week, but selling into the close along with a down day Friday closed the market below the middle of its Bollinger Band range for the first time since the March low. It was also only the first time since June and second time in almost 11 months the market dropped as much as 3 consecutive weeks. Here’s the weekly.

I don’t need to repeat what I wrote over the weekend. The long term trend remains up (I don’t specifically trade the long term trend because I’m not willing to sit in 10-20% pullbacks within the trend) while the short term trend remains down. Several shorter term breadth indicators are at levels that should soon produce a bounce if the “pullback within an uptrend” hypothesis is true. If it’s not true, we’ll know soon – the market will continue to melt down. Many times over the last 11 months the bulls have had to dig their heels in and defend their turf. Now is one of those times – it’s their strongest test yet.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 1)”

Leave a Reply

You must be logged in to post a comment.

I am going to go out on a limb here and state what I see with the VIX, VXN and put call ratio we have seen a bottom, or at least we are close to a bottom.