Good morning. Happy Wednesday.

We entered the week with bull’s backs up against the wall. They needed to dig in and defend their turf or else the “pullback within an uptrend” would turn into a downtrend. So far, so good.

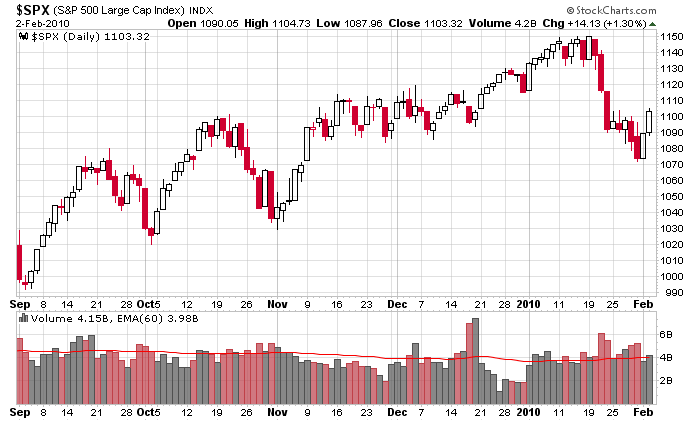

A week’s worth of losses have been recovered (plus some) in two days, but volume has been weak. Under most circumstances, I’d be happy with the market’s performance but a little uncomfortable with the lack of volume and in some cases, lack of leadership. But the last 11 months have been different than most cases. The last 11 months have seen the market turn on a dime and rally without ever resting or retesting it lows. Look at the chart below. The Sept bottom immediately led to 8 of 9 up days. The move off the Oct low was also highlighted by 8 of 9 up days. The Nov low was similar – 10 of 12 up days. During the current uptrend (yes the long term uptrend is still up), once the market turned, it never looked back.

This doesn’t make things easy. Each pullback messes up the charts, and then the market bounces before the charts can reset. But that’s ok. There will be plenty of charts to play once the market decides what it wants to do. There always has been. The jury is still out. Is a top in place and downtrend underway? Or would the recent selling constitute a pullback within an uptrend which differs little from the other pullbacks? We will see. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers