Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed with a bearish bias. Europe is currently up across the board. Futures here in the States point towards a small gap up open for the cash market.

We entered the this new week and month with the long term trend being up and the short term trend being down. Many short term breadth indicators had fallen to level that have produced bounces the last 11 months, so it was time for the bulls to once again step up and tell whether the correction was a pullback within an uptrend or the beginning of a downtrend. The litmus test I proposed was simple. The market acts a certain way within an uptrend, so if it continued to act accordingly, we could conclude the uptrend was in tact. Failure to match its previous activity meant a change was underway. So far, the bulls have at least held the line, but they can’t rest. Reactions to earnings are still not good, and the leaders are no longer leading. In fact there needs to be some significant improvement on many fronts for a bounce to have legs. Yesterday’s move came on light volume, so given the extreme bearishness, it’s not likely to hold.

It’s a battle, and I’m staying conservative with my trades. I make most of my money in middle of a directional move, not pinpointing a turning point.

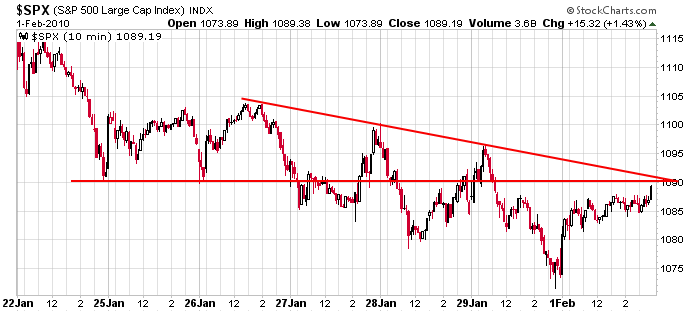

Here’s the 10-min SPX. Lots of up and down movement, very little net change from a week ago. 1090 is resistance. After that the index needs to break this lower highs, lower lows pattern. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers