Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

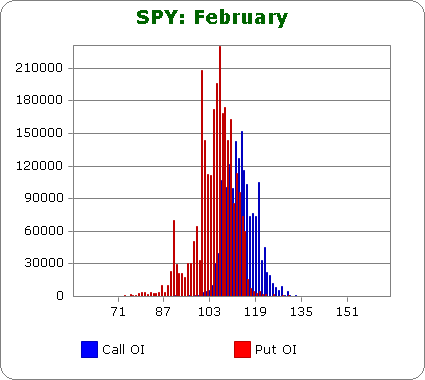

SPY (closed 109.74)

Puts outnumber calls 2.5-to-1.

Call OI is biggest between 107-116 with the 112, 113 and 114 being the 3 most popular strikes.

Put OI is biggest between 100-113 with the OI at 110 and below being most popular.

Since puts far outnumber call, to determine what price would cause the most pain, let’s focus on put OI. Since most of the higher-OI strikes are at 110 and below, the ideal close would be at 110 or above so all these strikes close worthless. But we don’t want to move too far up or else more of the call strikes will be further in money. Bottom line: a slight move up from the current level would cause the most pain and frustration.

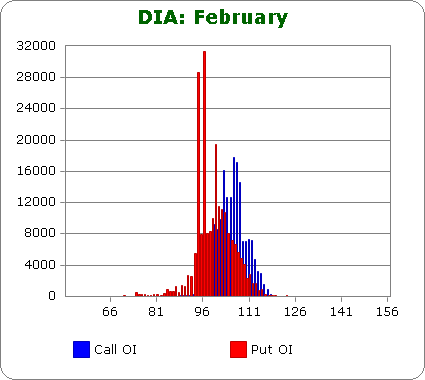

DIA (closed 102.81)

Puts outnumber calls by a small margin (last month calls outnumbered by a small amount, so it seems OI on the Diamonds get much less skewed than the others).

Call OI biggest between 100-108 with 103 and above being noticeably bigger than 102 and below.

Put OI is biggest 99-103, and there are two outliers at 94 and 96.

There’s some overlap between 100 & 103, and with call and put OI being about equal, a close in the middle of this range would do the most damage. With DIA closing at 102.81, slightly down trading the next couple days will cause the most pain.

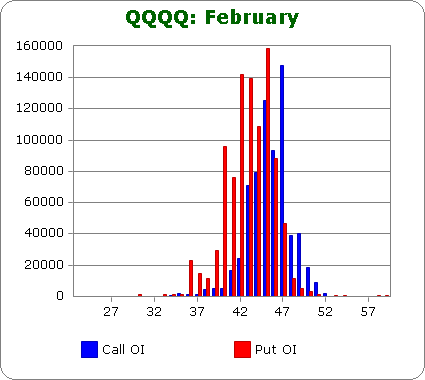

QQQQ (closed 44.32)

Puts outnumber calls 3-to-2.

Call OI biggest between 43-47.

Put OI biggest between 40-47.

There’s a big overlap there (most of the tall blue and red bars overlap). The two big blue bars are at 45 and 47; the three big red bars are at 42, 43 and 45. Since they both have 45 in common, I’m going to say a close there would cause the most frustration. Based on today’s close a slight move up is needed, but a flat market would be fine too.

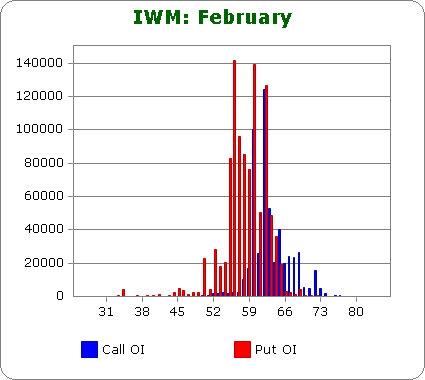

IWM (closed 62.05)

Puts outnumber calls by 2-to-1.

Calls biggest between 60-65 with 60 and 62 being noticeably bigger than the others.

Puts biggest between 55-62 with big surges at 56, 60 and 62.

There’s overlap between 60 & 62 with both those strikes displaying high OI for both calls and puts. A close between then at 61 would cause lots of pain. Based on today’s close, a slight move down would to the trick.

Overall Conclusion: Once again the bears outnumbered the bulls (puts outnumbered calls), but the degree is much less. Hence sentiment is still bearish but much less so. If this trend continues for another month or two, I’d be wary of a top and subsequent sell-off. In the near term, flat trading or little movement from the current level the rest of this week will cause the most pain and frustration.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Most pain to the buyer or writer?

to the buyer

Hard to fault this analysis.

Good work.

Great info for the suscription $

options that are recently opened matter more than “old options” in term of pinning based on recent bets by the big boys.

This might be true, but the invisible market hand seems to cause the most number of options to expire nearly worthless regardless of when they were purchased.

This type of analysis isn’t something I’d bank on…it’s just something I like to keep in the back of my mind.

Jason

Most pain to the buyer, most gain to the writer? What’s the formula? It seems like there would be an equilibrium point between PUTs and CALLs and then an analysis from that point as to which direction of price would cause the most pain/gain. I’d also say there’d need to be a degree of pain/gain indication in that is it worth it to attempt to drive price up or down. Maybe a lump that’s within reach as opposed to a tapering OI.

My sense is that looking too close or trying to create a science out of these numbers would not help. My point is only to get a general idea as to what needs to happen. To derive a complex formula that somehow predicts where SPY will close Friday is a stretch. The market can’t be put in a nice neat box. For me, it’s sufficient to simply say “a flat week with little change will produce the most pain.” To get more exact than that is not necessary IMO.

Jason

Interesting, but in the longer run irrelevant. Trading this week is not the objective.

The next move up will be energetic and last until mid May, one needs to be invested optimally and hold on for some money making.

I hope you’re right. It’s much easier making money when the market moves up than when it moves down.

Jason