Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board – most indexes gained at least 1%. Europe is also up across the board – many 1% gainers there too. Futures here in the States points towards a moderate gap up open. This comes off a fairly big, light-volume up day where the indexes almost completed the recovery of the huge Feb 4th losses.

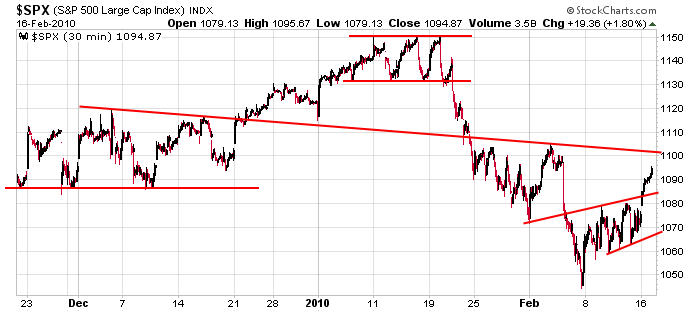

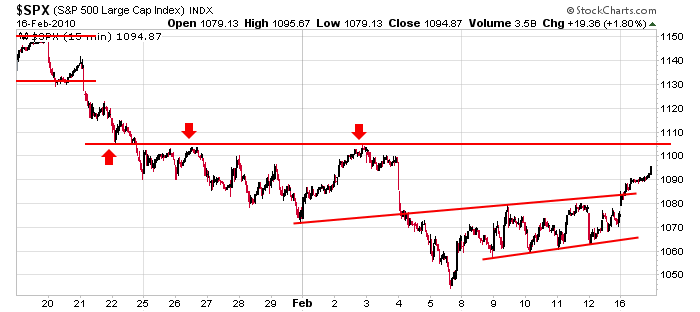

Here’s an update of the 30- and 15-min index charts. Resistance comes into play between 1100 & 1105. From there, I’d like a little backing and filling before attempting to bust out.

Per yesterday’s report, the put/call ratio says flat trading would cause the most pain and frustration among option buyers, but since put OI easily outnumbers call OI, upward movement would once again produce losses for most of the bears.

That’s it for now. The S&P has moved 50 off its low – not bad. Don’t get complacent.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers