Good morning. Happy Monday. I hope you had a nice weekend.

The Asian/Pacific markets started the week closing mostly up (only China lost ground, and there were several 1% gainers). Europe is currently mixed. Futures here in the States point towards a moderate gap up open for the cash market. This comes off a week the indexes rallied very nicely and took out resistance levels from two weeks prior.

Two weeks ago everyone was predicting the end of the uptrend and beginning of a new leg down. I was open to the idea (I don’t care what way the market goes), but with several internal breadth indicators being at oversold levels, I was looking for a bounce, and bounce is exactly what we got. Now many of those same indicators are in overbought territory, and considering the winning streaks (the Russell is up 9 of 10 days for example), the risk/reward for entering new longs isn’t good up here.

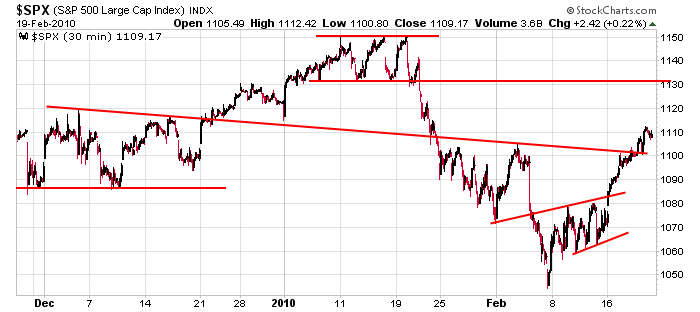

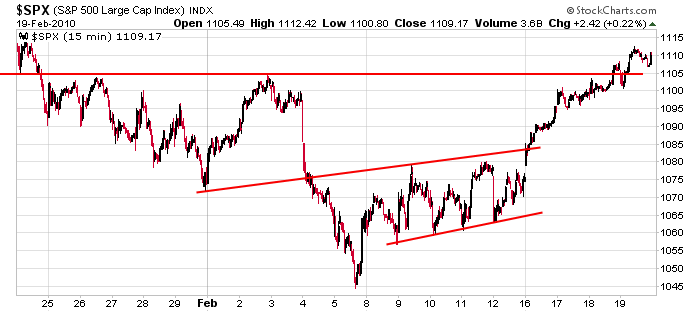

Early last week I identified 1100 (on the 30-min chart) and 1105 (on the 15-min chart) as S&P resistance. Both levels have been taken out. The next target is 1130, but I’d like the market to rest before surging higher.

Be careful out there.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 22)”

Leave a Reply

You must be logged in to post a comment.

I agree this is not the time to adding to new longs. I would not go short here either. Time to tighten up the stops.