Good morning. Happy Friday.

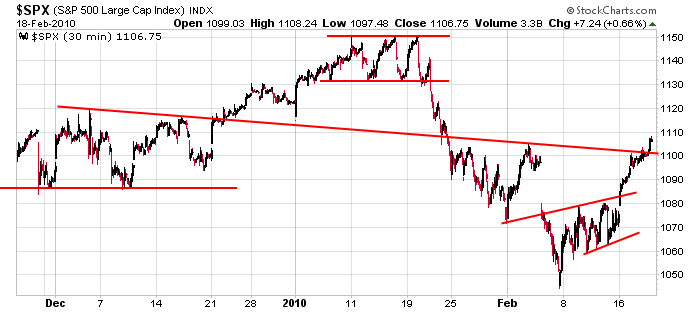

We got another nice low-volume follow through day yesterday. The S&P has now advanced 5 of the last 7 days, and for those of you who pay attention to the Fib retracements, nearly 62% of the move off the high has been recovered.

Then, after the market closed yesterday, the Fed raised the Discount Rate from 0.5% to 0.75%. The Discount Rates is the interest rate banks pay to borrow money from the Fed. It used to be frowned upon to borrow, but today it’s very common. The lower the rate, the more incentive to borrow and loan; a higher rate is a slight disincentive. I personally don’t think this change is a big deal. Banks have had plenty of time to borrow all the money they’ve wanted, and 0.75% is still rock bottom. The market had a slightly different opinion. The futures market immediately sold off, and at one point last night, S&P futures were down 12 – not a huge amount considering. Now they’re down 7 which is a pretty typical gap down given negative news.

I’ve talked before about how the Fed has played a role in the rally off the March low, and given this week’s rally, I wonder if they’ve been buying knowing this announcement was to be made. Better to gap down from a high level than a low level. Hmmm…

The Asian/Pacific markets closed mostly down. Japan and Hong Kong lost 2%. Europe is currently most down – there are no standout losers.

We’ve had some great runs this week – many new set ups broke out and rallied nicely. But news trumps the charts, so we’ll have to see what shakes out the first hour. Here’s an update of the SPX 30-min. Today’s open will be near 1100.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 19)”

Leave a Reply

You must be logged in to post a comment.

Good points.

To me the fact that the fed is raising at all with the economy still in the tank is disturbing. Today is options expiration day and that will be the big force today. Next Monday will be interesting.

I’m not so sure expiration day matters that much. Other than a little jockeying for position at the open, the day should be mostly factored in already.

As far as the rate goes…it probably only affects the banks. They’re supposed to borrow and lend, but they’re not. They’re borrowing and investing. They’ll make less, but they won’t be lending less because they weren’t lending in the first place.

Jason