Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Europe is currently posting moderate gains. Futures here in the States point towards a flat open for the cash market, but this could change when GDP data is released 60 min before the open.

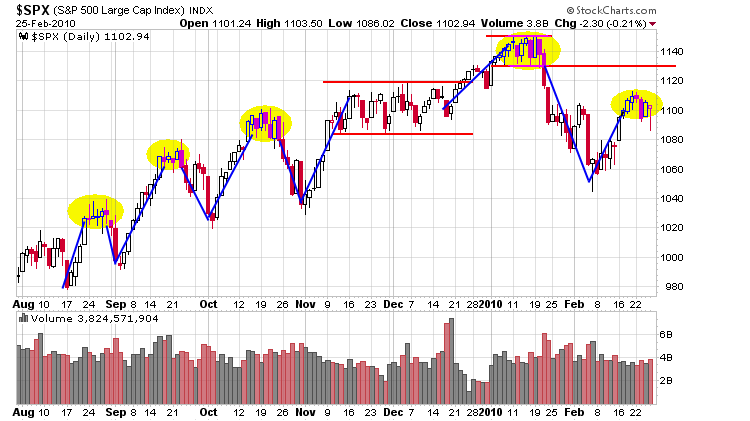

We began this week with the indexes being in a short term uptrend, but the risk/reward for new long positions wasn’t favorable. It was time to play defense given there wasn’t much support or resistance close by. What have we gotten? Lots of movement, but the net change for the S&P is only 6 points.

In my opinion, the market needs a little more time to work off the short-term overbought nature heading into this week. Overall I’d say things are in pretty good shape – I just question the upside potential should the market decide to rally right now. Here’s the S&P daily. There will be lots of resistance up there between 1130 and 1150, so I’d prefer a longer resting period than we currently have. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers