Good morning. Happy Tuesday.

So much for a little pullback or some sideways movement to allow the breadth indicators to drop more. The market gapped up yesterday and closed with solid across-the-board gains. The Nas, S&P 500 and Russell 2000 had big up days that took out their previous swing highs. The Dow lagged.

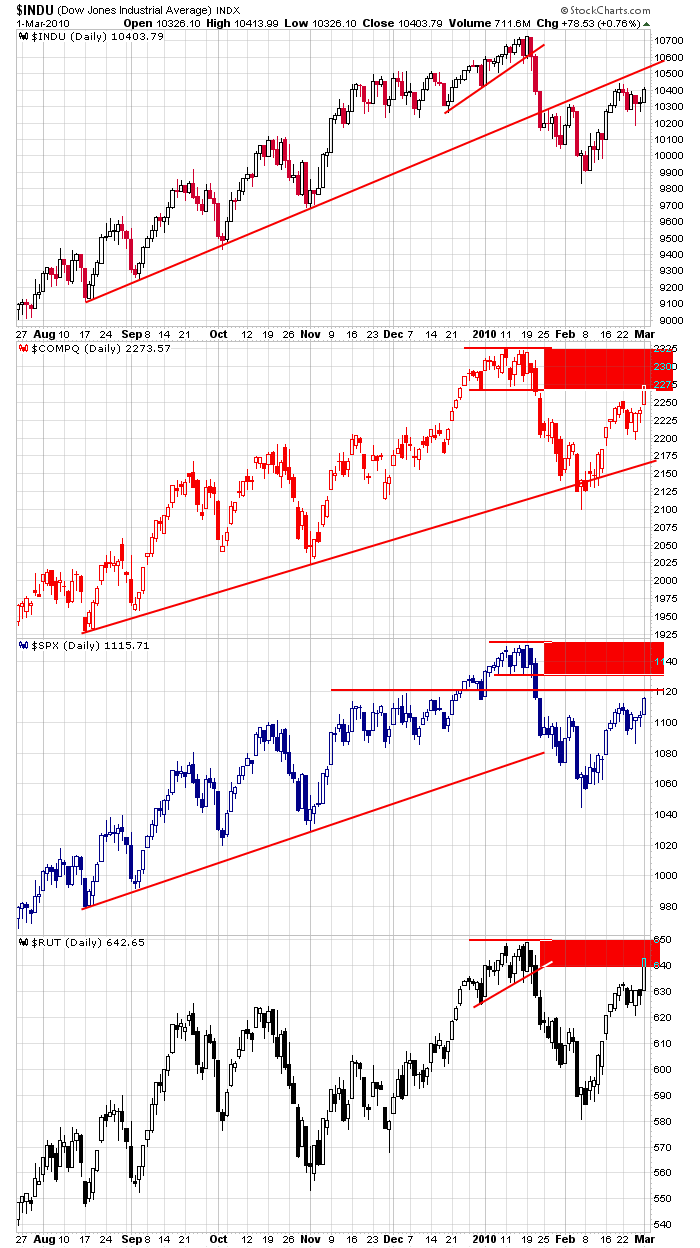

Here are the daily charts. The Nas and Russell are into areas where many traders would love to get out even. They bought at the top and are thrilled about the action the last couple weeks. I maintain my 1120 and 1130 resistance levels for the S&P. The Dow is lagging – most likely because the banks are lagging.

Futures indicate a moderate gap up open. Hmmmm. So we got a solid up day yesterday and now a gap up today – I’m not sure I’d chase this.

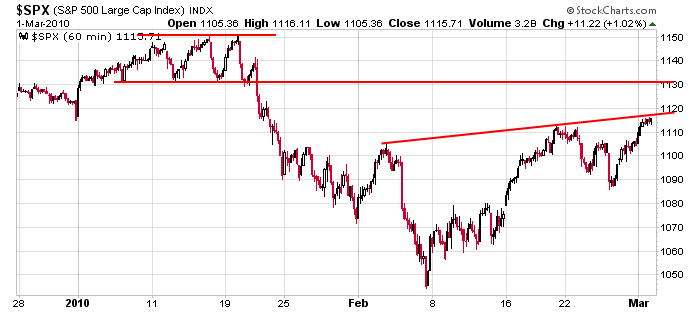

Here’s the 60-min S&P. I hate it when the index gap through a resistance level. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 2)”

Leave a Reply

You must be logged in to post a comment.

mr jeyson, please tell mr arron to get into long bond for eoq run. any dip after jobs report or auctions should be bought. it is ready to pop significantly. regards to the bond king.

darn, bonds are not pulling back at all. an even bigger rally than i thought seems to be brewing. stocks might take a quick and sweet hit in the process. to the tune of 20-30% and euro may collapse to parity before 2010 closes. butt watching time.

Jason I don’t think this one is worth chasing either!

I’m writing calls against making new highs. Nothing like getting better than top tick.