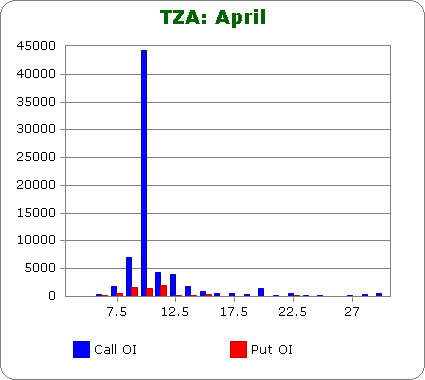

The graph below shows the put and call open-interest for TZA, which is a triple inverse small cap ETF.

If it’s true that most options volume is buying as opposed to selling, someone is betting huge the market is going to get clobbered in the next 6 weeks. Your thoughts?

I’d say this is good reason the market will continue to chug along just fine. 🙂

0 thoughts on “TZA April Call Open-Interest”

Leave a Reply

You must be logged in to post a comment.

the amount of open long calls in SPX for march may also speak for relief puking for April because the IRS is going to take $900+ Billion in Income taxes. Last year the IRS collected 2.3T A big chunk comes in April. Also that’s a good time to start hiking rates by June 30!!!

But I thought the old saying was: sell in May and go away, not sell in April. 🙂

Must be one of Obamas buddies with inside info.

i think today marks at least a short term peak

Based on what? And what is your definition of short term?

It could be a hedge. Did u look at the other open contracts?

Jody I have not looked that deep into it…I just noticed this a month ago, and I keep watching as the OI grows bigger and bigger. Have you noticed anything?

What is this risk/reward ratio?

It depends on when you buy. This large number of contracts wasn’t just purchased overnight. The position has been slowly getting bigger for the last month. For those that bought when the stock was at 11, well, they’re not too happy right now. If you buy now, the calls will cost you 50 cents. That’s your risk. If a totally unexpected event happens in the next 6 weeks, you could multiply that several fold…but something has to happen.

Remember the large number of Puts just before 9/11. Somebody knew something then too.

Yes, but I remember several years ago a similar situation playing out with SPY and everybody lost. It was Sept and the Dec puts for a particular strike (I don’t remember which one) was massive. The market never fell and all those guys lost everything (unless they were writers).

Maybe Mahmoud Ahmadinejad is active in the markets these days, you know,

bomb, bomb, bomb, bomb bomb Iran.

Either that of someone like Soros is setting up a hedge of some kind.

The question I have is what did the market maker(s) that took the other side of this position use as a hedge?

I’m sure they just buy futures contracts, but this isn’t a huge position.

44,000 contract for TZA is big, but SPY has many call and put strikes that have well over 100K contracts.

JASON……..i think you are smarter than that..having read your insight for a yr r 2…..before the bell…….

ie.the mkt is gonna go where it goes…try to predict…where you want it to go..is a fools game…agreed??? i know you know that.so this post makes no sense to me….

Frank I’m not predicting anything, but I do have a bias based on data I look at. The market likes to take money from people, not give it out. With sentiment being bearish, I lean to the upside. That’s not predicting, it’s just developing a frame of reference to trade from.

Given that the integrity of the markets is so much in question, it’s not unlikely that somebody feels very comfortable about knowing the market direction. There are many who feel that the market has to be tanked at some point to scare people in to buying Treasuries. Otherwise, there’s not enough demand. Maybe someone got the word that the time has arrived. Helicopter Ben says he’s not going to buy the Treasuries (anyone believe that?). Hey Jason, at least we know where max pain is on TZA next month.

Jobs # this Friday?

There must be a lot of down and out people.

Maybe it is Robert Prechter from Elliott waves they have it as a wave three down.

Many leveraged funds appear to not accurately follow the performance of the underlying /index .

I think this is because they have to rebalance daily due to the leveraged nature…..

http://finance.yahoo.com/news/ProShares-Ultrashort-bw-3447760790.html?x=0&.v=1 Article I saw today- Perhaps all 3x funds don’t have the same issue- Do your homework before thinking they’re a longer term position. SD

True…TZA took out its Jan low today…$RUT still has further to go before taking out its high.

I’m not sure the leveraged nature matters because we’re only talking about 6 weeks. And besides TZA would go to 0 if left alone, and it wouldn’t matter what the market did. That’s just the way the math works out, and that’s why the creators of some of these products are getting sued.

I really like your site and all it’s info. Great job.

As far as the markets go, We have came along way since last March and here we are almost a year later and the NDX has been up some 82.7% from the low to the high with barely even a pullback until Jan.–Feb. 2010 period. NOTHING continues to grow forever, so as you might guess I am not really in the bullish camp. I am more inclined to be bearish here and expect a 20% decline relatively soon, off the NDX 1900 top, so I see the NDX at 1520 or as low as 1400 within the next 6 months. Of course I will be wrong as everything in the financial world is just wonderful! That’s my take!

I don’t care what happens…as long as I get movement to trade. 🙂

According to Elliott Wave Theory the Dow is going down to 9000

and the S&P is going down to 975. And all that is supposed to

be happening very soon, I’m afraid.

that is a hedge position, not a pure bet.

You are likely right, and as I responded above, 44K contracts is a small position relative to the OI for SPY.

The STOCK TRADERS ALMANAC says that the end of March takes some mean hits at quarters end. Obama has nothing to do with it. The last 3 or 4 days of March has seen the Dow go down for 14 of the last 18 years.

I am personally not a big fan of the Traders Almanac. If you take the average of too many years, you get something in the middle that isn’t useful. I think they’re wrong at least as much as they’re right. JMO.

Great find. Who ever purchased all of these options did not seem to care who did all of the buying. Just before 911 the short options were purchased discretely here someone purchased a gob.

Actually this isn’t a bid position.

44K is small compared to well over 1 million open-interest SPY has.

I have been reading from the same people that said the banks would probably be hit in sept. of 08

that this spring will be bad for the markets, we’ll see.

Thanks for your comment kkmart. We will see.

good chart. I would say the it shows the confidence of the sellers. With the odds favoring sellers of these options I would tend to agree that the market holds together and these expire worthless.

This is almost certainly a hedge. Faz and other triple inverse ETFs have similar skewed positions. In my humble opinion, these have become so popular as hedges that the TRIN is not as valid an indicator as it once was since S&P puts are being replaced by inverse ETFs as the primary hedge vehicle thus compromizing the TRIN calculation.

I agree that this could possibly be a hedge. With VIX down here, this makes a lot of sense as a cheap way to hedge a portfolio that was probably up nicely in Feb.

Think about the seller, he must have deep pockets also and he believes market is going or at least Financial are going up. It could be negative if seller sold then same amount of calls. That at least shows he does not know trend and he is just trying to collect premiums. Over and above 3X funds burn premium fast, So seller still can come out winner. Buyer of calls has only 25 % chance to win seller has 75, what one should take?