Good morning. Happy Thursday.

The Asian/Pacific markes closed mostly down; China lost more than 2%. Europe is currently mixed and mostly flat. Futures here in the States are flat.

Two consecutive days the market has been strong early and weak late. The market is up for the week, but most of the gains were registered on a single day (Monday).

With the Nas and Russell into their resistance zones and the S&P close to its own resistance and with several breadth indicators similar to the NYSE AD Line I posted yesterday, a little pullback is due. Or, at the very least, the risk/reward for new trades isn’t great. Be picky about the set ups you enter right now. Don’t give them much leeway. Stocks that break out at the beginning of a run tend to do well – even if they don’t deserve to. But stocks that breakout after the run has started have to be a stronger individually because they get less help from the rising tide.

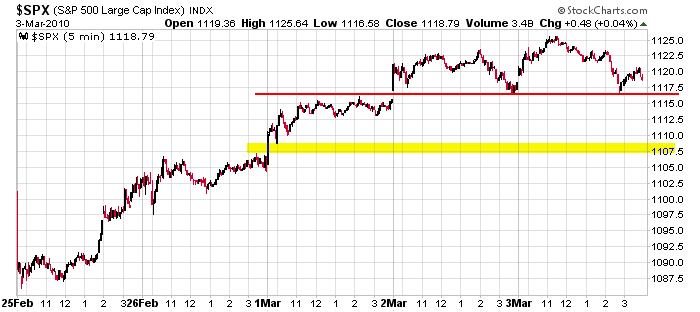

Here’s the 5-min S&P chart. Monday’s resistance turned into support Tuesday and Wednesday, and we still have a gap (noted in yellow).

Employment numbers come out tomorrow 60-min before the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers