Good morning. Happy Friday.

Employment numbers are out. Here they are:

unemployment rate: 9.7% (it was 9.7% last month)

nonfarm payrolls: down 36K

average workweek: down 0.1%

average hourly earnings: up 0.1%

At the time of the release, the Asian/Pacific markets had closed up across the board (there were a couple 1% gainers), Europe was up across the board, and futures here in the States were up 4-5 points. The entire planet was green. After the release, futures shot up and are pointing towards an open above the week’s high.

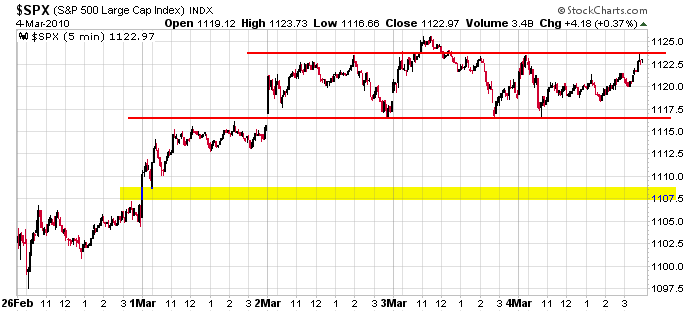

We entered this week with the market being in consolidation mode and me hoping for a continuation of the sideways movement. We got a big up day Monday and some decent follow through Tuesday and then a pretty tight range Tuesday-Thursday. Here’s the 5-min SPX chart.

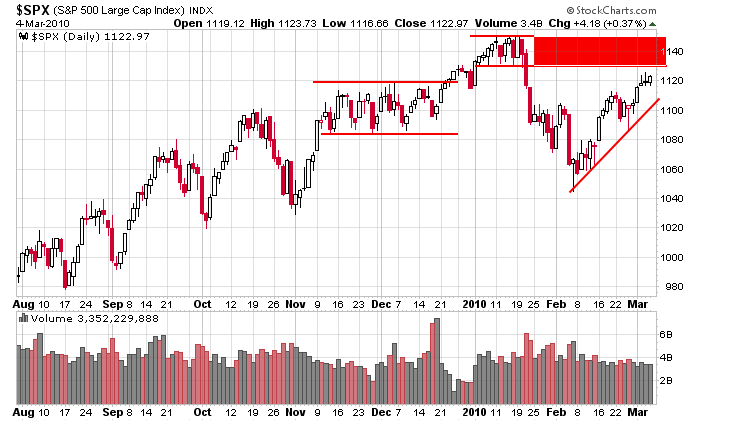

The Russell has already traded above its resistance zone. The Nas is in the middle of it zone. The S&P (shown below) is 7 point away. This disparity needs to be resolved. Are the small caps strong enough to pull the S&P through resistance or will the lagging big caps hinder the small caps progress? Something has to give.

I’ve looked at a lot of charts the last couple days. My bias remains to the upside, but given SPX resistance just overhead, it’s hard to justify being aggressive. The trend is up, but the risk/reward isn’t as favorable as I’d like. This weekend I’ll take another look at the breadth indicators to see if any are at extreme levels. If not the market will have to move on its own rather than relying on a regression to the mean. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 5)”

Leave a Reply

You must be logged in to post a comment.

who cares. stopped buying stocks and am better off picking one of the auto trading methods on C2.

havent made a dime in the last 12 months.