Good morning. Happy Tuesday.

After yesterday’s slow, narrow-ranged day, anything goes today. On a short term basis, my bias is neutral. Heading into this week, the S&P had moved up 6 consecutive days and 11 of the previous 14. I was looking for a day or two off but could also make the case for a blow-off top. The breadth indicators are at elevated levels but have a little more room to move before being considered overbought. Short term (over the next couple days), anything goes. Intermediate and long term I see no reason why the market doesn’t go higher.

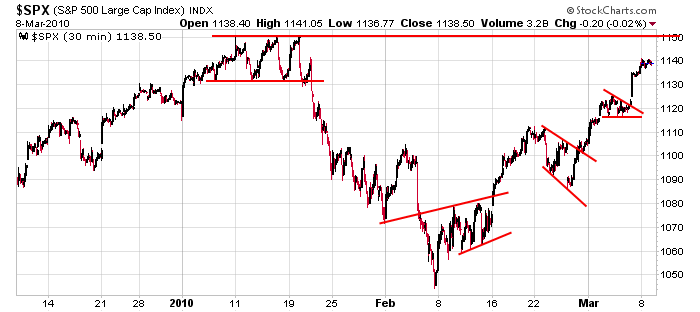

Here’s the 30-min S&P chart. On a very small scale the index is in no-man’s land between potential support in the mid 1120’s and resistance at 1150.

That’s it for now…more after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 9)”

Leave a Reply

You must be logged in to post a comment.

I’m a Canadian, but I follow U.S. politics and Washington policy initiatives closely. Yes, the U.S. economy is improving, but the stock market may not be fully factoring in the short-term downside risk if the healthcare reform bill is passed through the process of reconciliation, which could precipitate a market selloff. I have one April DIA 106 put, purchased last Friday, which I hope to sell profitably today.

I have much appreciate your comments, Jason.

iwm 50 train is leaving the station, vooop vooop