This is my third report covering the technical aspects of the newspaper group.

It’s said a picture is worth 1000 words. Well on Wall St. a chart is said to be the sum total of all the thoughts, feelings, emotions and opinions about a company and that the chart is always right.

I don’t find this to always be true. In time, stocks go to where they’re supposed to go or deserve to go, but in the near term, getting overextended to one side or the other is common.

Charts also tell us where traders and investors are “lined up” to enter or exit positions, and once these levels are penetrated (analogous to a running back getting through the line of scrimmage and into the open field), stocks often “run” 10-20%.

Let’s review the charts and see if any of the newspaper stocks I’ve been covering are ready to run or if they’re churning behind the line of scrimmage.

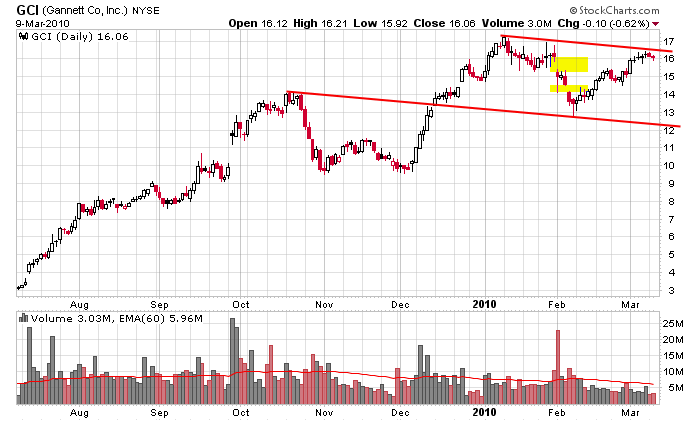

Gannett (GCI): Overall the stock is trending up, but on a shorter term basis, is forming a falling rectangle pattern. This is a bullish set up – temporarily trading against the overall trend acts to shake out weak hands, and once enough have exited the stock and been replaced by newer shareholders who are not frustrated with the stock’s lack of progress, the stock is free to breakout and rally. Longer term investors would be wise to hold here as the trend is up. Shorter term traders should take all or partial profits here and look to rebuy on a pullback.

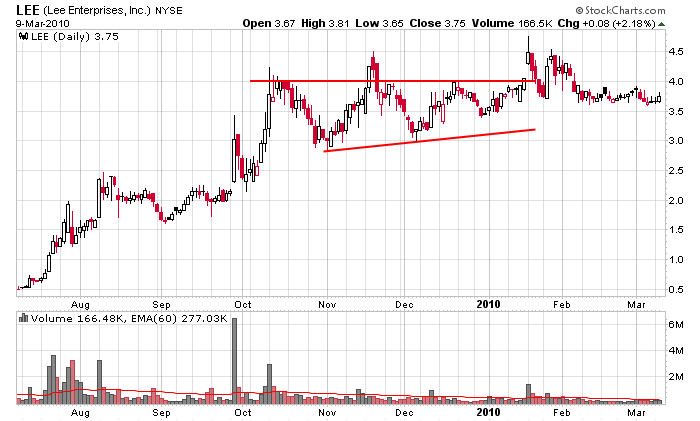

Lee (LEE): Each time this stock has made a higher high (mid Oct, mid Nov, mid Jan), it got turned back soon after. The overall trend remains up, but the stock has been dead money for five months. From a trader’s perspective, there’s nothing here to play.

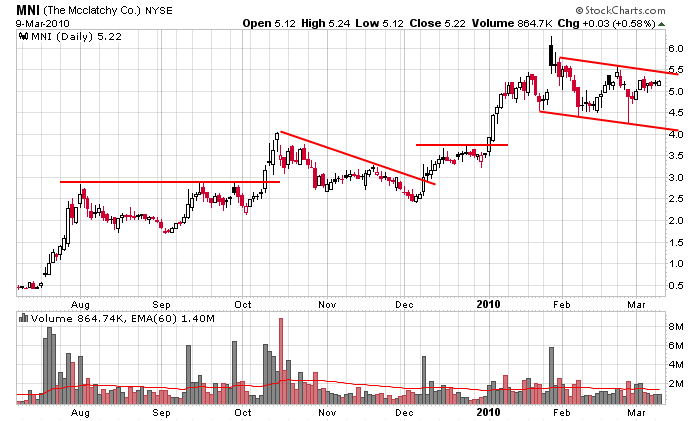

McClathy (MNI): Like GCI, MNI is trading in a falling rectangle against its overall trend – a bullish set up. But because the stock goes through long streaks of sitting in tight ranges, it’s better bought on a dip than on a breakout. The trend can’t be denied, but the difference between getting in at the top of the pattern or bottom is 20% – too much for a low-beta stock.

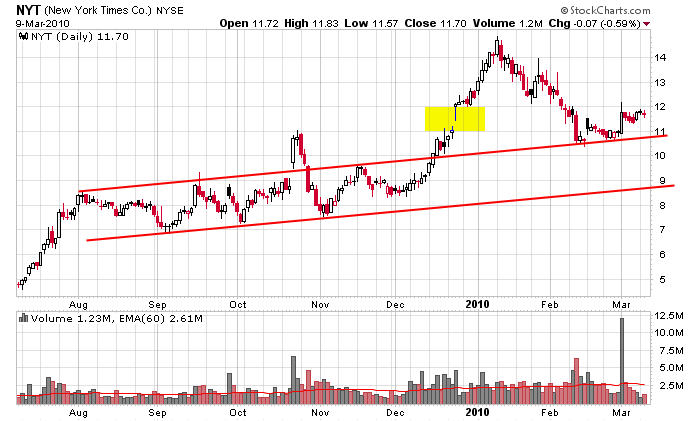

New York Times (NYT): This chart gives me a chance to demonstrate a phenomenon that often plays out. That is that an ‘old’ trendline which seems to not be important any more suddenly defines an important level. Such has been the case with the top trendline drawn below which does a pretty good job ‘describing’ the Aug-Nov movement and then halts the Jan/Feb selling pressure which filled the Dec gap. This is now support. This is where the stock is ideally bought assuming the overall market remains healthy, but if the trendline is broken while the market weakens, the downside target is at the bottom trendline near 9.

My conclusion the first week of January was that the stocks were nicely trending up, but they were too far gone to chase. A pullback was needed for better risk/reward entries.

My conclusion the first week of February was that the market trend was still up, but enough doubt had been cast to take a wait-and-see approach.

Unfortunately I haven’t written about the group since the first week of February, so I haven’t had a chance to update my bias until now.

The market has clearly strengthened. My conclusion is that the market is healthy and these stocks are consolidating, and barring a change in sentiment, they are buyable on dips.

0 thoughts on “Newspaper Stocks are in Consolidation Mode”

Leave a Reply

You must be logged in to post a comment.

i’d rather buy a newspaper than a newspaper stock. gotta love those deep technical analyses of sub-$5 stocks. there’s a reason they are trading in low single digits. they are going to zero.