Good morning. Happy Friday.

The Asian/Pacific markets closed mixed – China lost more than 1%. Europe is currently up across the board. Futures here in the States are flat.

The market is on a heck of a run. The Russell has moved up 20 of the last 22 days. The S&P’s winning streak is 14 of the last 18, and the S&P has taken out its previous day’s high 9 of the last 10 days. It just keeps going and going and going. I call it the Energizer Bunny market.

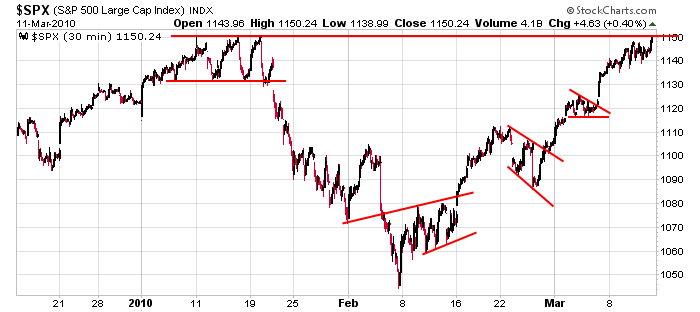

The Russell and Nasdaq have already cleared resistance. The S&P is there right now. Here’s the 30-min S&P. Everything that was lost in Jan & Feb has been recaptured.

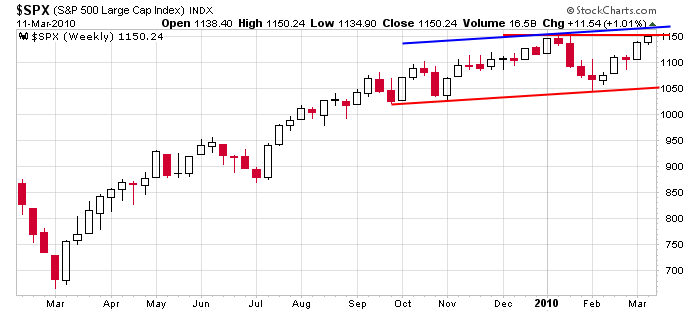

But although 1150 is resistance in many trader’s minds, I view the 1160-1165 as stiffer and more significant resistance per the weekly chart below. This conveniently gives the index a chance to make a higher high and suck in more buyers and cause more shorts to cover right before a drop plays out (maybe).

The trend is up, so the long side is the only side I’m willing to play, but caution is warranted here. This run isn’t going to go forever.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 12)”

Leave a Reply

You must be logged in to post a comment.

According to Elliott Wave Theory we could go up a little bit

higher in here, but caution is definitely the word. When the

market wants to drop it’s going to drop hard and fast, and

quicker than anyone expects, I’m afraid.

I like the weekly chart with targets. Could you extend the chart and add your own pivot lines. Being an amateur swing trader this would be of most benefit to me. A weekly/monthly projection with daily updates.

Thanks

iwm 50. voooop voooop.

Yup…looks like the market will be pulling back next week just in time for Options Expiration….We’ll see what happens.