Good morning. Happy Monday. Hope you had a nice weekend.

I don’t have much to add to my weekend report. The market is on a heck of a run, but it won’t last forever. Some of the breadth indicators suggest we’re close to a local top, but I’d expect any type of pullback to get bought – with the broad-based strength, I see no reason the uptrend will end soon.

Sure we could have a blow-off top and surge another couple %, but the risk/reward for entering new positions right now isn’t great. I’m not one for guessing a top like the bears constantly do, so for now the long side is still the only side I’m interested in, but I’m much less likely to give charts time and space to play out.

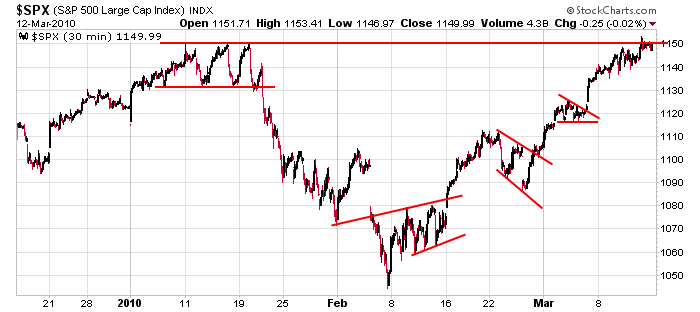

Here’s the S&P 30-min chart. For what it’s worth, the index is at the Jan high. Logically this would be a good place to rest, but the market hasn’t been very logical lately.

That’s it for now. I’ll have more to say after the opening bell.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers