Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

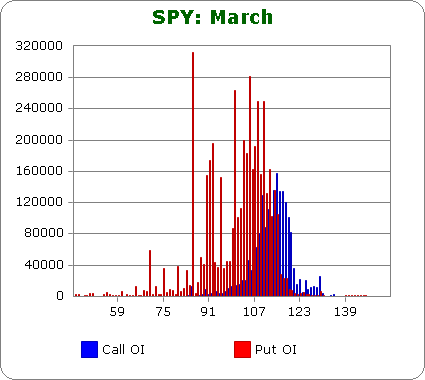

SPY (closed 115.49)

Puts out-number calls by 2.3-to-1, so there’s lots of bearish sentiment out there.

Call OI is highest between 107 & 120.

Puts OI is highest at 115 and below.

Given the dominance of puts, if we want to know what the market must do to cause the most pain, let’s focus on the puts and ignore the calls. With the stock closing at 115.49 today and put OI being highest at 115 and below, a flat market the rest of the week would expire all these puts worthless – a very painful situation for the bears who bet on a big downside move.

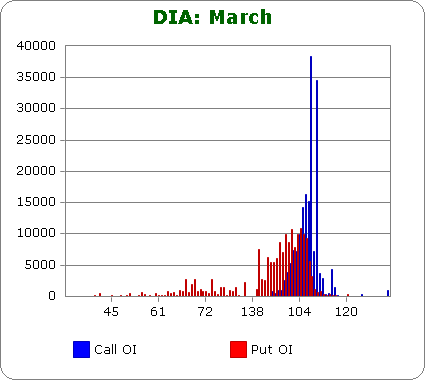

DIA (closed 106.57)

Similar to the last two months, put and call OI for DIA is equal.

Call OI is highest between 104-110 with spikes at 108 and 110.

Put OI is highest at 107 and below.

With overlap between 104-107, that’s where DIA needs to close Friday to frustrate the most number of people. The stock closed at 106.57 today, so flat-to-slightly-down trading this week will do the trick.

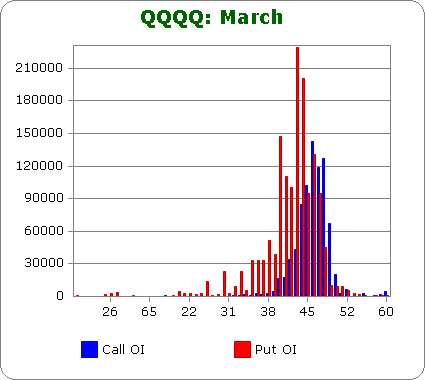

QQQQ (closed 47.24)

Puts out-number calls by 2-to-1.

Call OI is highest between 44-49.

Put OI is highest between 40-48 with the biggest spikes being at 43 and 44.

The zones overlap between 44-48, and since puts far out-number calls, a close in the upper half of this range will cause the most pain. With the stock closing at 47.24 today, a flat market the rest of the week is what’s needed to close the most number of calls and puts worthless.

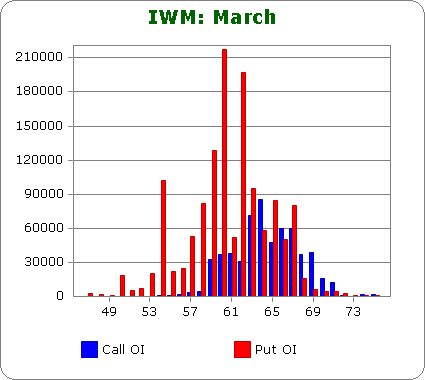

IWM (closed 67.49)

Puts out-number calls by 2.5-to-1.

Call OI is highest between 59-69 with spikes being at 63 and 64.

Put OI has spikes at 50, 54, 59, 60 and 62 and a few smaller spikes at 63, 65 and 67.

Since puts far out-number calls, let’s focus on those to determine what the stock needs to do this week to cause the most pain. A close at 67 would of course close all these put spikes worthless, and a close slightly lower would do the trick too because being slightly in-the-money still won’t enable the buyers of 67 puts to make money. With the stock closing at 67.49 today, a flat market would accomplish the mission.

One more just for fun.

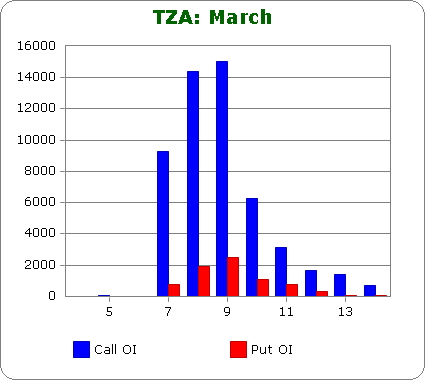

TZA (closed 7.39) – this is 3x inverse small cap ETF.

Call OI out-numbers put OI by almost 15-to-1, so lots of traders are betting on the market dropping (which would cause this stock to rally).

Call OI is huge between 7-10.

Put OI is relatively small between 8-10.

Obviously a close at 7 would expire all those calls worthless, but a small move up from the current level wouldn’t give the call buyers a profit because the stock wouldn’t be far enough in-the-money. A flat-to-slightly-up market would cause the most pain.

Overall Conclusion: The bears have once again bet big on an expected move down. Given the put/call OI zones for each of these stocks and Monday’s closing levels, a flat market the next couple days will cause the most pain.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

great work

with the fed and health care this week it doesnt seem likely we will have flat week but that sure would frustrate most

very original analysis mr jeyson. is it your invention? 🙂

this market has been stronger than the january 12th week but the patterns are very simlar and we closed that week flat too. If we make a flat top I am looking for a january repeat but less of a pullback this time

Jason this is the best put call analyses on the web. I have always been a big put call watcher. Thank you!

Thanks! 🙂

Jason, very useful and thanks for the benefit of your time and research. This deepens the perspective(s nec to understand waz goin’ on. thx a lot.

great analysis Jason! Sounds like it will most likely be a choppy week!!

I don’t understand that we need to start from the assumption that the market wants to inflict as much pain as possible. The market is neutral, it does what it wants, nothing more and nothing less.

In theory this is true, but in doing what it wants, it seems to inflict the most pain. This is why the market reverses when sentiment gets overloaded in direction or the other. As Warren Buffett says, be fearful when others are confidence and confident when others are fearful. The masses are rarely correct.

Thanks Jason , you didn’t mention it but I’m thinking that quite possibly after this week’s pain to the bears there will be some profit taking next week

Also , could you please have an explanation on how it is manipulated so that the market causes the most pain to the majority ? , is it just that there has to be a balance of buyers and sellers ? , thanks , Dave

The masses can’t be right. If everyone is betting on a move in one direction, then everyone has already taken a position. Assuming this is true, who is left to push the market is that direction?

wildebeest says:

The market is neutral, it does what it wants, nothing more and nothing less.

Not really the case. “The market” is the collective actions of all participants. Some participants make their own weather while the rest of us try and figure it out.

The q’z are in for some very good volatility this week. I don’t know which way. Lower limit around 46.08 and an upper limit around 49.38. Just guessing.

Sorry , but oi in puts means that they were written, so the market is bullish.The writters of puts hopes that the puts expire worthless.

Hmmm….can you provide a link that documents this?

correct me if I´m wrong but OI only says what positions have been opened and not yet closed – this takes both sides into consideration: long and short.

So OI is rahter a measure of liquitiy in a given contract (and therefore can cause interest if it´s massive) than a max pain-indicator.

For every long option that expires worthless and causes pain, there is a short option that can keep the collected premium explodes in joy… 🙂

cheers, K

please add a ‘and’ between ‘….premium explodes…’….thanks 🙂

For every long option that expires worthless and causes pain, there is a short option that can keep the collected premium explodes in joy…