Good morning. Happy Wednesday.

The Asian/Pacific markets had a very strong day today with most of the markets gaining at least 1%. Europe is currently up across the board, and futures here in the States point towards a positive open.

The Fed spoke yesterday. Rates were left unchanged, and their “statement” was very similar to previous meetings. They said things are slowly improving, but they’re still concerned with the housing market and employment situation. The market was up into the announcement and after some choppy action, moved up more and closed at its highs.

The Energizer Bunny market continues. It goes up and up and up day after day. All the indexes are at new highs or are very close.

But there’s been a tendency to reverse the post Fed move, so be on the lookout for a give back today. It’s as if the initial knee-jerk reaction is wrong, and after traders have a chance to think over the Fed’s statement, they realize they were wrong and do the opposite the next day. Anyway, it’s just something to keep in the back of your mind.

Otherwise the breadth indicators are in overbought territory. I think one of two things happens soon. 1) The market tops and pulls back (but the temporary weakness will get bought and new highs will be made again – the overall trend will remain up) or 2) Ignoring all indicators and logic, the market will melt up – we’ll have numerous days of huge buying pressure that will completely break the backs of the bears. I’m not placing odds on either scenario, but considering every little dip gets bought and the indexes keep grinding to new highs, I slightly favor the melting up option.

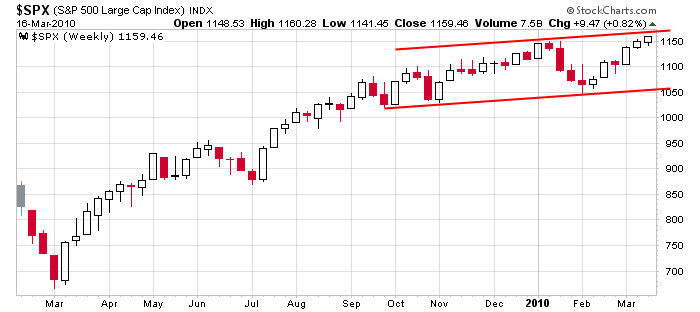

Here’s the SPX weekly. There may be resistance just overhead?

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 17)”

Leave a Reply

You must be logged in to post a comment.

As I have said many times before, according to Elliott Wave Theory

the markets are due for a big pullback, not just a shallow one.

I mean c’mon think about it. Do things really look all that

great to you? Does a bear crap in the woods? Ya damn right!

Be on the lookout for a big pullback in the markets.

The Fed will probably pull a fast one on everybody like

they did after the bell a couple of weeks ago. HW

I know nothing about Elliot Wave Theory. 🙂

Jason

Good read. I would not expect a lot to happen until Monday. I would not add to long positions at this time.

There are dozens of reasons why it makes no sense for this market to be going up. But that doesn’t matter, the only thing that matters is that it keeps going up. You would think they would have to tank it at some point in order to scare people in to buying Treasuries. Does anybody really believe we can sell $4.5T in Treasuries this year? $1.5T in new borrow and $3T rolling over. None of that matters right now as they continue to “Buy, buy, buy!”

“…the only thing that matters is that it keeps going up.” — bingo!!!

It appears that the fund managers are buying everything regradless of the danger ahead based on increasing debit, potential loss of AAA credit rating, and the European issue starting with Greece. To add to this downside potential the FED will stop buying mortgage debit at the end of March, and the stimulus fund starts unwinding, with no significant job stimulus.

One must go with the flow and the flow is up for now, but a watch out for a April reaction to the pending negative activity.

Melt-up! Melt-up! Melt-up! Melt-up!

We all know that you never fight the ticker tape. However, all the increasing price movements are based on low volume, which indicates a lack of conviction. In the previous great depression, the market also went up in the next 12 months after the bottom but then gave most of it back over the following 12 months. It then took the second world war to correct the unemployment situation and it was not until the 1050’s that the market starting to really gain. Is this going to be the same. History does not necessarily repeat but it is like a mirror which does reflect the current situation. The market should not and can not continue ignoring the unemployment rate, the huge amount of debt of the various countries around the world for which interest must be paid. The one great unknown is China and India.

As always, timing is everything.

The market may go up for another year….go back down to test the lows…then back up…then back down…and then in 2020 the real rally may begin, and this 20-year period may be a little blip in the grand scheme of things. 🙂

Does anyone know where I can get similar charts for the put call ratios for Australia as Jason did yesterday for SPX DJI etc. They were fantastic and would be so helpful to me as I only trade in Australia

TIA

I have no idea Elsbeth. Here’s a link to where I got the US data…

http://www.schaeffersresearch.com/streetools/indicators/open_interest_configuration.aspx?ticker=

Jason

Thanks Jason for your reply. We often follow the US these days to a certain extent so I will keep watching for your graphs – which were sensatinall – and the explanation were excellent. It made a lot of sense to me as I had been viewing it from the opposite direction. I will try the above link.

Keep up the excellent work – even if I do only get to read it after we have traded most of the evening on the futures exchange.