Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Europe is currently mixed with a slight bearish slant. No index anywhere has moved much from its unchanged level. Futures here in the States are flat.

The Energizer Bunny market continues. New highs were made across the board yesterday. Nothing was left behind. Strength is broad-based, internals support the price movement. The only warnings come from a lack of volume and possibly the market being “too strong” (when sentiment is over-weighed on one side, that side will be the wrong side).

You guys know me. I don’t guess tops. I’ll guess a bottom because those are much easier and tend to happen on a single day, but tops tend to be of the rounded variety and there’s always a few extra surges up to crush the bears who jump the gun with shorts.

News barely matters. The economy doesn’t matter. Housing. Unemployment rate. I guess those don’t matter much either because there’s a huge disconnect between Wall St. and Main St. It’s very possible for Wall St. to continue moving up while Main St. suffers.

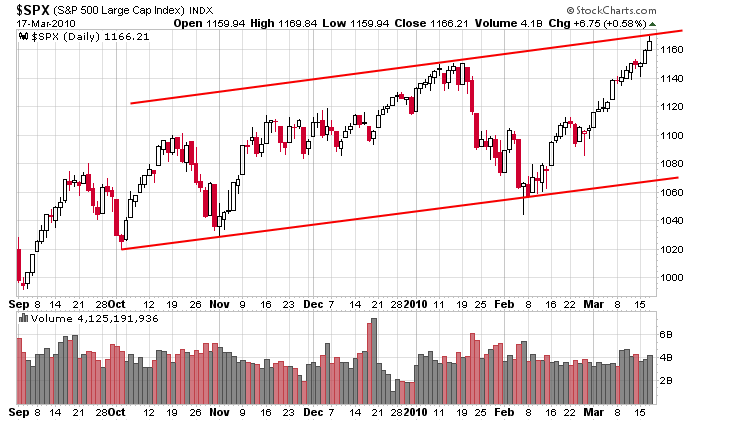

Here’s an S&P daily chart I drew last week. I put it up because a target I had establish has been hit (I talked about 1163ish being stiffer resistance than 1150).

That’s it for now. The long side is the only side to be on. But be cautious.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 18)”

Leave a Reply

You must be logged in to post a comment.

Good analysis. Just discovered your blog.

Would you expand on your bottom picking technique? Can you quantify what you’re looking for or is it a seat of the pants thing per bottom?

I use a slow stochastic and volume. A candle stick hammer is nice. Long tails on ten day plus oversold seem to indicate a good bottom. A bounce off the 20 or 50 SMA is a good sign.

Rich…all my indicators are of the “breadth” variety.

At a bottom, the put/call will spike, the VIX will spike, the # of new lows will spike, the A-D line will plunge, etc etc.

The opposite is not true. You can’t turn these indicators upside down and treat them the same at a top. The VIX can stay low for a long time…when the # of new highs spikes, the market typically continues up…etc etc.

Bottoms tend to form in one or two days of hysterical selling while tops tend to roll over.

Jason

I agree, bottoms are easier than tops. Thanks. I’ll take a look at the A-D line.