Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. Europe is down across the board – there are a couple 1% losers. Futures here in the States point towards a decent gap down open.

Last week, the Dow, Nas and S&P gained ground while the Russell dropped. Given the Russell had been leading, it makes sense the index dropped the most. Some will say the stocks and groups that lag on the way up do the worst when the market tops and rolls over, but that’s not how things work in reality. The stocks and groups that rally the most turn around and drop the most when the market pulls back.

The big news over the weekend was the passing of a healthcare bill by the House.

All last week, despite the continuation of the uptrend (until Friday’s weakness), I was in a conservative wait-and-see mode. The trend was firmly in place, but for various reasons, I didn’t think playing new upside breakouts was a great idea. The risk/reward wasn’t great. Breakouts that occur at the beginning of a leg up do great because they get lots of help from the overall market. But breakouts that occur within a mature trend have a harder time because it’s not easy tacking gains on top of gains.

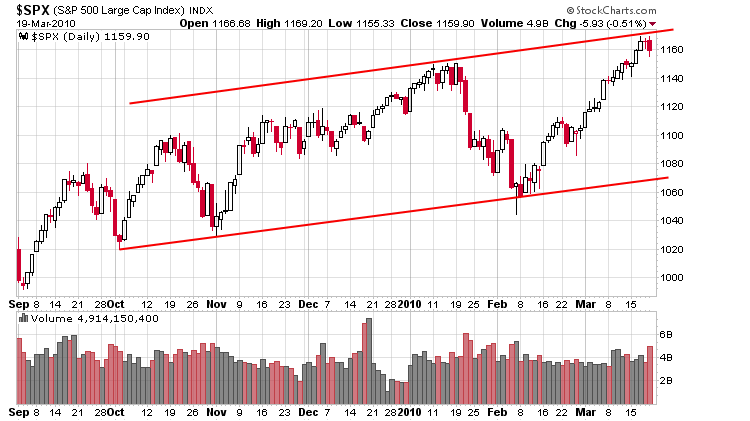

As of now I’m still of the opinion the trend is up, but a rest is needed. But there remains a possibility the market ignores everything and ‘melts up.’

Here’s the S&P daily.

My attitude entering this week is the same as last week…I’m not crazy about chasing breakouts to the long side, and I don’t have much interest in going short other than for quick trades here and there.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 22)”

Leave a Reply

You must be logged in to post a comment.

I agree with Jase, I see a rough go on chasing moves higher for stocks that are at or near highs for the year already. As for shorting, it’s never really easy to get short, if you short on the way up then you likely will be wrong at any given moment and find yourself adding to losing positions, and shorting on the way down is very uncomfortable for most to chase a move once it has already started.

In my view you either have a system in place to deal with both scenarios and follow it, or you stumble and second guess yourself constantly, probably losing money the whole time. Jase gives great charts to use with stops and triggers and traders would be served best to follow that advice and use his guidance. You won’t win every time but you will have a greater percentage of winners then losers, which is far better then 98% of individual traders. Leave the active trading to those who have the experience and tools in their chest to do so. Stay nimble, know your exits, take profits relentlessly…… :}

Chanting, “Melt-up! Melt-up!”

Well darn! I was going to buy MNRO at the open but changed my mind. Oh well.