Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Europe is currently up across the board. Futures here in the States are flat.

I think the market surprised some people yesterday. After Friday’s high-volume down day and yesterday’s gap down, it seems everyone was expecting the beginning of a pullback. Instead the market rallied off its gap down open and everything closed up.

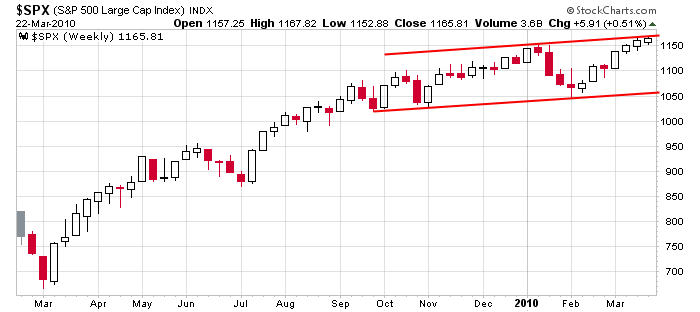

The weekly S&P is still at resistance in my opinion. Here’s the chart.

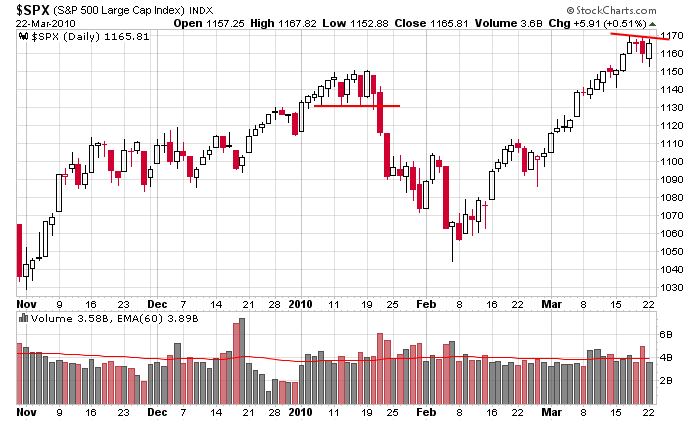

The daily is setting up in a flag pattern. We’ve not had 4 days of sideways movement. Here’s the chart.

Here’s something that’s been on my mind. Oil has been weak lately. The chart below compares the S&P to the number of energy stocks trading above their 10-day MA. Energy has been leading the market. In each of the market pullbacks the last 7 months, energy rolled over first, and right now, not only has the energy curve rolled over, it also formed a negative divergence.

The overall trend remains up and the market feels like it wants to continue up, but there are starting to be some warning signs. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 23)”

Leave a Reply

You must be logged in to post a comment.

Nothing I have read reduces the cost of health care ; it just changes who pays for it , and that would be the people who are spending and supporting this economy . A 40% tax on medical devices will be paid in your deductible and in higher insurance costs . Businesses do not pay taxes ; they pass it along to the consumers . If it really costs Caterpillar an extra $100 million per year to do business as they claim , do you think that might mean less jobs and smaller , if any , pay raises ? I see less money for consumers to spend and a double dip recession , if we don’t turn it into a full blown depression .

Yep, too bad health care reform won’t improve the health of the labor force.

What are the implications of weak oil?

My conspiracy theory: the oil companies have lots of money. They’re going to drive the energy market down forcing alternative energy out of business. Then they will buy all the alternative energy at a discount.

I view weak oil as weak demand.

Oil is one of those groups that feeds off a healthy economy but then chokes it off as prices get too high.

As far as alternative energy goes…I think we are many years (maybe even two decades) away from there being an alternative energy that significantly cuts into oil’s role in our world. JMO. Lots of press…not much progress.

Zacks thinks energy will be an earnings winner in 2010. Doesn’t seem to fit in with weak oil?

Based on current Zacks Consensus Estimates, earnings for companies in the S&P 500 Index are expected to increase by 22.8% in the first quarter of 2010. For the full year 2010, earnings are expected to advance in excess of 31%. This would reverse the trend of the prior two years, when earnings dropped 10.1% and 23% in 2009 and 2008, respectively.

Just to give a context for the downturn, even after the solid earnings gains this year, overall S&P 500 earnings would still be below the 2007 level. As would be expected at this stage in the economic recovery, the earnings growth this year will be led by finance, basic materials and energy.

Oil is over 80 bucks…I’d expect earnings to be good. But the group still goes through cycles of being overbought and oversold. My chart has to do with the current situation, not the overall picture.

I think your Energy trend indicator is a good indication of the market at large. There is a cycle low coming at the end of the month and energy has a good correlation with the S&P of which it is a significant sector. But, in the long run energy is a buy here since there will eventually be a shortage of the oil part of the energy sector. I like the big integrated oils. I think they will double or triple in value within 24 months more or less.

Good graph I forward it to others. Keep it up Jason.