Good morning. Happy Friday.

The Asian/Pacific markets closed up across the board. Europe is currently down across the board. Futures here in the States point towards a moderate gap up open for the cash market.

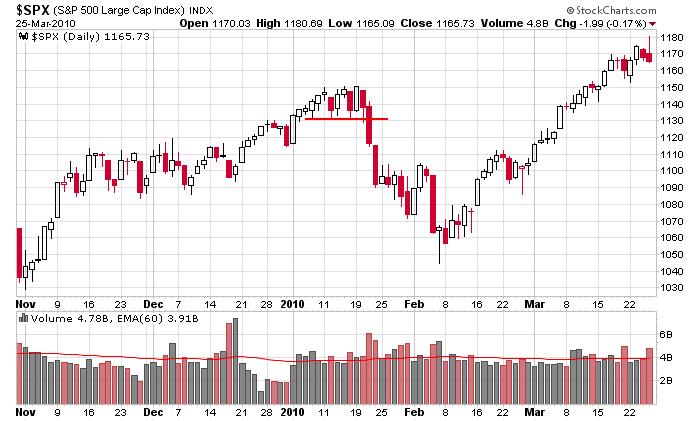

After pressing to new highs yesterday, the market actually dropped yesterday. The closing numbers weren’t bad, but the day’s candle wasn’t pretty.

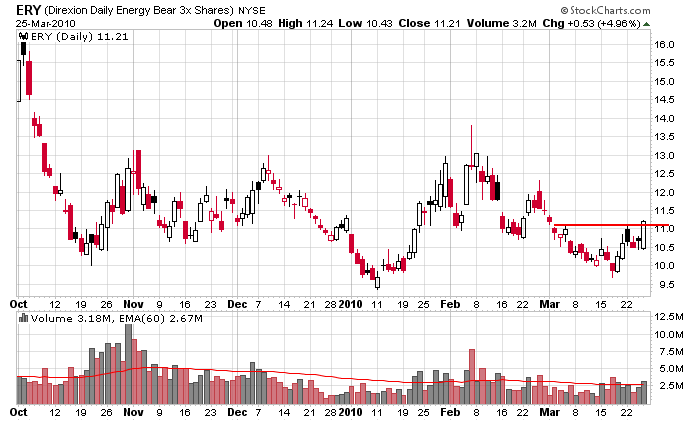

I’ve talked a couple times about energy and how it’s weakening. Here’s the 3x inverse ETF.

Here’s the daily S&P. Recently the down days have come with greater volume than the up days. That’s a warning. There are others such as various internal breadth indicators that have been in overbought territory and the rallying dollar. But as you can see, the market has been in a huge uptrend. I’d expect a pullback – if we ge a pullback – to get bought. In my opinion any trade to the downside is short term unless it becomes obvious holding is wise. Next Wed marks the end of the quarter. Given the run we’ve been on and the pressure on fund managers to be holding certain stocks that have done well, I’m not sure the market is going to completely fall apart right now.

Otherwise we entered this week with the market in bull mode and me in conservative mode, and it looks like this is how we’ll end the week. I’m not sure there will be many new additions to the trading lists this weekend. We’ll see. The market will ultimately tell me what to do. Don’t give profits back.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 26)”

Leave a Reply

You must be logged in to post a comment.

the trend is up but i am conservative. it is a bull market but this is no time to be aggressive. if the market goes up, i told you the trend was up. if the market goes down, i told you this was no time to be aggressive. i cannot lose. heads i win tails i win again. anybody who calls out my little scheme hates me and is my enemy. i am a freakin’ genius.

I still agree with you on the possible pullback. However, my thought process says it will happen next week after the close of the quarter–some funds claim 3 day settlement –so it could start monday. I believe the fund mgrs will want to book some profits and this will allow them to show they are holding certain stocks and still post an increase. Just my 2 cents.

mr wolvie, it warms my heart that you welcome me with open arms to jeyson’s playhouse. but srhn left the board almost a year ago and is not coming back. he doesn’t want to be there and he is not wanted there. he is not an lb member anyway so he cannot post even if he was dying to.

and mr jeyson, i don’t post under fake names. because there are no real names here. when i have a comment, i make up an alias and post my comment. you can keep accusing me with lowly conduct, but none of it is true. we know your conduct very well too. no need to remind you to your own audience. peace..

mr wolvie, i have a full time job, i trade a zillion portfolios and i am really having a tough time coping with your and others’ deragotary remarks on the mb. and i am not into yahoo message board kind of environments, which is what lb mb exactly is.

instead of posting about me behind my back where i cannot respond, i’m sure you can get my e-mail so just directly write to me if you have something to say. i have left that place long time ago and i see no reason for myself to be the discussion topic on the board. bunch of gossipers is what you guys are, led by that jeyson guy who decided to mention me out of the blue yesterday and it came to my attention.

i post comments here once in a while, so if anybody has anything to say, they can respond here rather than just gossiping elsewhere. bless your heart too and good luck 😉

I have known Jason for many years. He is not only fair and unbiased, but is always willing to give worthwhile advice that actually resulted in GREAT (and I mean GREAT) trading methods. I, for one, learned a great deal from his wonderful website during the time I was a member. From your mention of Wolvie and SRHN, I believe that you were once a member of this site as I was. I have no idea who you are, but I find your comments sad at best. I wish you the best in the future, but I hope you can find better use for your time.

Kez

which of course begs the question why you left if it were such a great and profitable service. but i won’t ask it. none of my business and i don’t really care. one is better off trading leveraged etfs or futures rather than buying breakouts and then blaming the market for non-follow through. or trend is up but too riky to go long commentary. or having spy in the long list when it was @142 with a target of 162 and then boasting that members were kept safe from the huge bear market. but folks should pay a few bucks and learn it the hard way. school of hard knocks is not free 😉

here come the king’s men, in disguise of course. bless your heart too Mr Kezha. signed, srhn.

I will make one comment regarding Jason’s comments. Simply put, on the Daily Chart the Relative Strength Indicator (RSI) 14 crossed above the zero line back on February 16th and has never crossed back. As for a very simple way to play the market using only one indicator…this one works well in a trending market. Therefore, I agree with Jason’s comments that the market has been in a bull mode for quite a while, the “BUY” was back in February and now is a little late to get in the game. It may continue to go higher here or not…but the BUY was back in February. As long as that RSI is above the zero line (given the gains) I would stay bullish. Of course, you could exit when it breaks the current trendline OR the RSI crosses back below 70. Different strokes for different folks.

Kezha

What’s your STOP method Liar Liar?