Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed with an upward bias. Europe is currently up across the board. Futures here in the States point towards a moderate gap up open for the cash market. This comes off new highs being made across the board on Tuesday and a slow range-bound day yesterday.

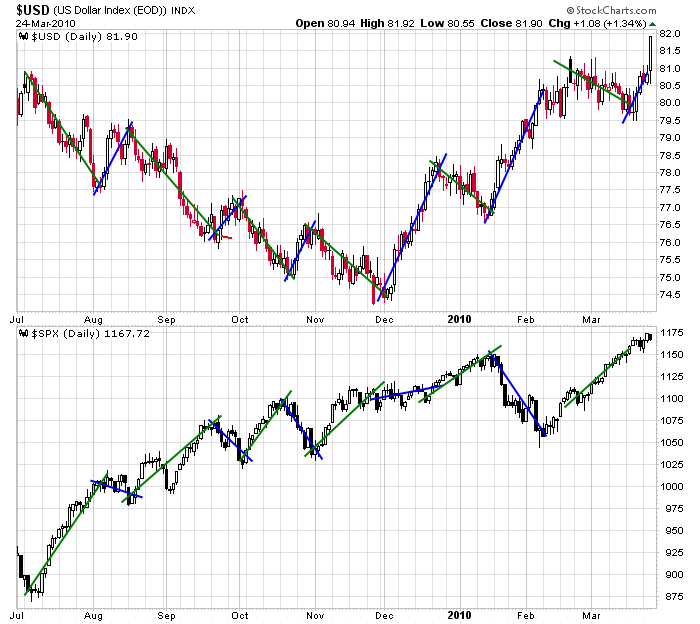

The US dollar has – for the most part – been inversely correlated with the market. When one goes up, the other goes down. Here’s a chart which shows that other than early Dec, they’ve moved opposite each other. Yesterday the dollar rallied big time. It’s something to keep in the back of your mind.

As the market moves up, I’m running out of things to talk about. The market keeps going and going…it won’t drop…it won’t pullback…it barely rests…it has started to ignore warning signs. I’m not complaining because my bias has remained on the long side the entire time, but I certainly wouldn’t mind a pullback that lets the charts reset for a subsequent leg up.

From my perspective, we need to keep doing what we’re doing. Play the long side, but don’t get lazy. And don’t guess when the run will come to an end. How much have the bears lost trying to guess a top? More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 25)”

Leave a Reply

You must be logged in to post a comment.

Sounds like you’re bored Jason. In that case, what indicator/system would you build to day trade the S&P Emini?

iwm 50 voooooop voooooop. last call. get into otm year-end puts @iwm 70 and go on spring break. take advantage of the low vix. don’t buy near-term puts, tops can take a long time to develop but it won’t go any higher either. so anything above iwm 69 is just fine for TF (futures) shorts. as soon as you see tlt below 87, buy the long bond futures or tlt calls or any other way to buy longest dated u.s. government bonds. no other country, no corporate bonds. just the safest long dated stuff. sell any and every pop in gold, oil, copper, euro and the like. you will get a chance to buy most back two years and 60-90% later.

i hate those leveraged etfs but i could not help get into faz @12.65. i will put them up for sale in the fall for 100 and there will be a big line in front of my door.

nope jeyson, i have not been very bearish for a long time. in fact, i had bought every news-induced drop so far. i shorted iwm @68 and 69 via TF, did not even buy my iwm puts or put in es/spy shorts yet (have the orders in at spy 120 for that). but thanks for sharing the info with old friends and foes on the mb. please say hi to all for me 😉

oh, and don’t forget to tell arron the bond king to buy the 30y futes and calls after another 2-point drop. i’m sure he can use the cash 😉

you can be sure i don’t access your site under any other member’s name, neither did i join under another name. i am not surprised you would blame me with such lowly conduct, but i would not bother with that kind of stuff. neither do i hate you, we just had some disagreements and moved on. remember that i wanted to stop by for a month as part of my naked options trial, but you would not allow me (against your advertised promise). no need to misrepresent the situation to lb members or gossip behind my back. speaking of lowly conduct..

jeyson, now your members are all riled up against me and calling me names. yet i had been gone from your board for almost a year and it was you who brought my name up out of the blue. you have done it again, you sure are a master of this. rock on :d