Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – losses were moderate. Europe is currently mixed with a bullish lean. Futures here in the States are point towards a moderate gap down open.

For what it’s worth, today is the last day of March and of the first quarter of 2010. I’m sure whatever whatever buying and selling fund managers wanted to do has already taken place.

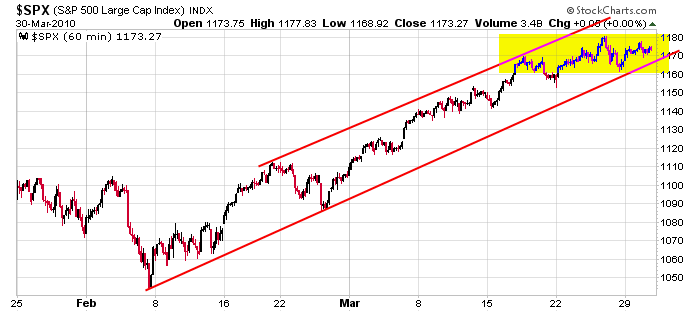

About two weeks ago I turned more conservative with my bias. The overall trend was up, but for various reasons, I felt the market needed to either pullback or drift sideways to work off the overbought condition. What’s happened? It’s moved sideways in a relatively tight range. The good news is the movement is healthy and constructive and will help lay the foundation for the next move up. According to the indicators, we’re probably halfway there. The bad news (this isn’t really bad news) is it’s been a little frustrating to trade. Over the last 9 days, we’ve had 5 up and 4 down and very little net change.

Here’s the 60-min S&P chart. I’d love a pullback to 1040 or even 1020. 🙂

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 31)”

Leave a Reply

You must be logged in to post a comment.

Do you mean 1140 and 1120 (not 1040 and 1020 as stated in today’s morning report? typo?

Yes mur44…typo…meant 1140 and 1120.

Hi Jason,

I cannot see any further basis for upside right now. It there is further upside I will see it as potentially a false break which will make downside even more steep. I am hopeful for minor correction down here and further move up. The longer this lingering sideways move takes the sharper the down correction will be.

At the end of the day – beware – there really is no good news out there fundamentally. The global financial sector is dead in the water. It is not a pretty sight though may take a while yet to unfold.

Elsbeth…anything is possible. There was no fundamental reason for the S&P to rally from 1050 to 1170 the last 8 week, so why does there need to be fundamental reason to rally further.

I don’t know what the market is going to do…but I do know that the trend is up, and I’m not going to fight it.

Jason

Elsbeth,

Agreed!

out half faz @13.66 (+1), hard stop @12.66 for the rest. let’s trade around it as it churns before launching towards triple digits for year-end. keep building those short and put positions on pops, not on drops. iwm 70 and spy 120 would be perfect spots for year-end put entries if you can get it. voop voooooop. ka-ching ka-chingggggg.