Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Europe is currently mostly up, but gains are small. Futures here in the States point towards a small gap up open for the cash market.

Yesterday the market did a whole lot of nothing. We entered the week in pretty much the same state that existed last week – with the trend being up, but many warning signs flashing that a rest was needed. The market could pull back or drift sideways to work off the overbought condition. So far it’s drifting sideways.

Tomorrow is the end of the quarter and then the market is closed Friday for Good Friday.

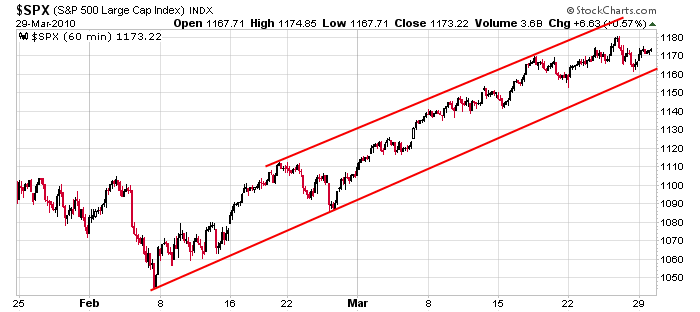

Here’s an update of the 60-min chart. No change from yesterday.

That’s it for now. I’m not going to just fill up space when nothing happened yesterday worth talking about. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 30)”

Leave a Reply

You must be logged in to post a comment.

Mr RichE,

I trade so many types of products and time frames that I cannot give a coherent answer to you about stops. For some products (way otm options), no stops if the position goes against me. They expire worthless. Longer term or itm or otm but closer to money options, i trade them like futures. Whenever my charts or other indicators tell me it’s not a good trade anymore or my pain threshold is hit, I get out and salvage what I can. With futures, I also trade intraday and swing. With futures swings, same as itm options. With intraday futures, I trade very leveraged so I have mechanical stops that I keep trailing. For anything else, I don’t use mechanical stops. I also buy into weakness and sell into strength (I don’t buy breakouts, I don’t go long on an up day, I don’t trade in the direction of the gap unless it fills and holds) and I always add as the position goes against me. I start small and multiply my position as prices get more attractive. So I don’t even worry about stops until I have a full position. Stocks, stock indeces, bonds, currencies and grains all trade very differently, so my entry/stop methods are somewhat different for those markets. I hope I could answer your question.

Thanks. I agree with you on heavily leveraged options, it’s easier to expense them, they move so quickly. I agree with getting out when it doesn’t look good anymore, but how do you define, “doesn’t look good”? That’s what I’m looking for is a proactive stop algorithm. I don’t like mechanical stops. Like I do all this entry analysis so why don’t I put as much energy into exit analysis?