Good morning. Happy Tuesday.

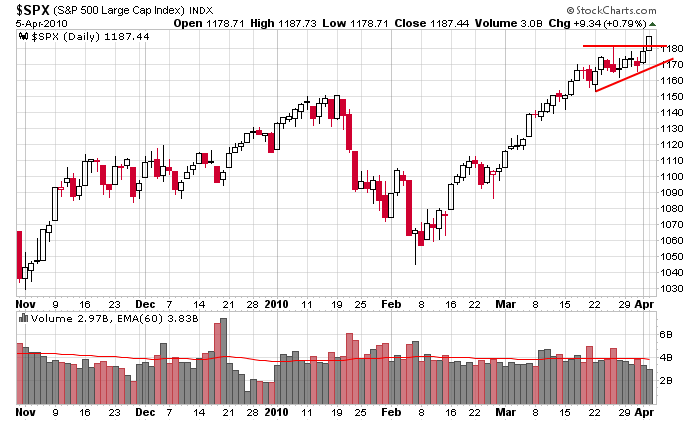

The good news is the market closed at new highs yesterday. Here’s the S&P chart.

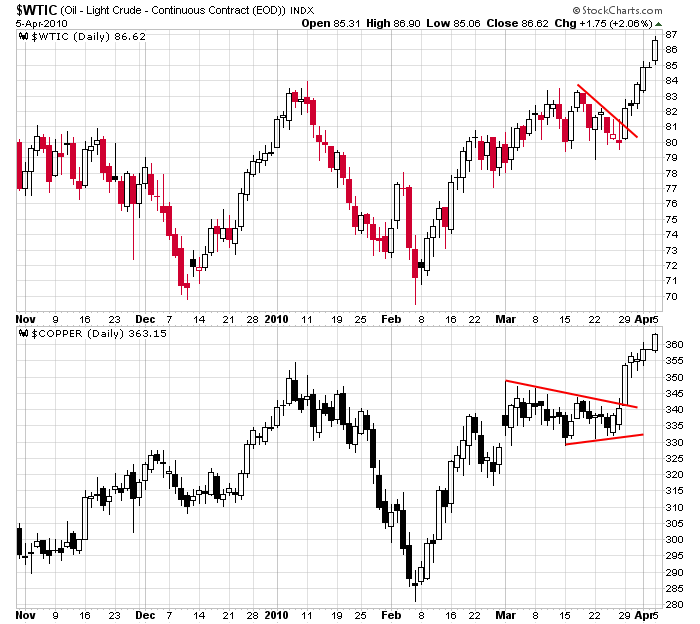

Also good news is oil and copper made new highs. These commodities do well when the economy is doing well. Here are those charts.

The bad news is volume was very light and in several cases, the indexes are at or near resistance. The Dow is just under 11,000; the S&P is just under 1200; the Russell is just under 700.

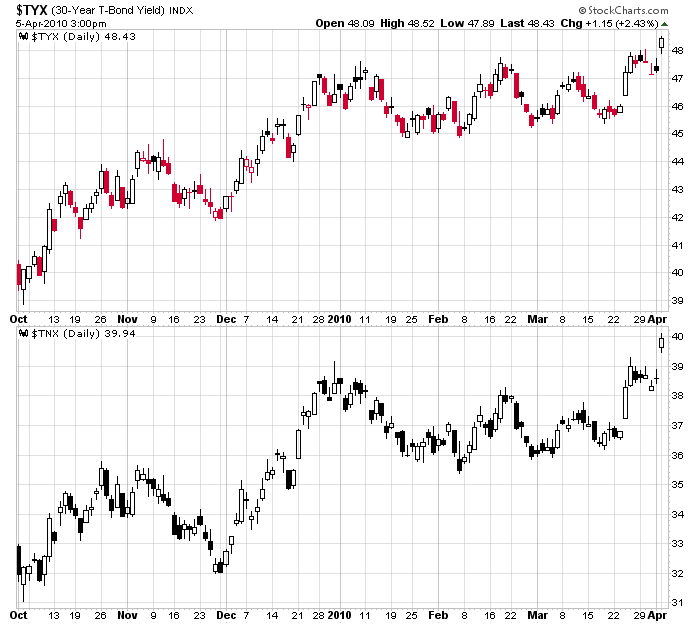

Also bad is the movement of bonds. Here are the 30- and 10-year yields – both made new highs yesterday. In my eyes, bonds are competition to the stock market. The higher the yields, the more likely people are to pull money out of the market and put it into virtually riskless bond.

Yesterday was a nice day but we are not out of the woods just yet.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 6)”

Leave a Reply

You must be logged in to post a comment.

Your bond competition observation is historically sound, but I wonder if it holds in the face of continued profligate spending by Congress, and the Treasury is locked in to paying whatever it must to roll its short term debt forward. Bad choices at Treasury have about 800 billion a year rolling forward in the one to three year range. The illusion that the Fed will hold the short end of the yield curve down is in direction conflict with its desires to remove QE from the money supply. We treasury and Fed are in a head on conflict. I am betting rates rise this fall and that hurts equities.

I’m bond challenged. What’s the expected yield on the 10 and 30 year SPX? I don’t see how you can compare bonds to equities without calculating a net yield for equities.

I made a whole $11.52 on an $8,500.00 investiment today.

I am so edgy about where we are and where we are going I can’t justify being in the market. I sold and took a 10 buck profit.

Something is going to happen – it can’t continue, this is madness IMO.

my year-end iwm put orders are getting filled today. just got some large fills around 70.25. average cost for the iwm short (futes and options combined)around 69.50 iwm now.

es/spy put orders waiting for 120 still.

also have a nice chunk buy order for faz @12. obviously much much smaller than everything else though. i don’t really like stocks.

under 87 tlt i will start taking a hard look at bond longs. if i can get 85, i’d be in with some size. tlt calls and ZB/ZN are the ways to play this.

best of luck friends and foes 😉