Good morning. Happy Wednesday.

Except for China, the Asian/Pacific markets closed up across the board – gains were not great. Europe is currently mixed with a bearish lean. Futures here in the States point towards a gap down open for the cash market.

Yesterday, except for the Dow, every index made a new high. Is this a divergence worth noting? Maybe. I personally am not going to read too much into it.

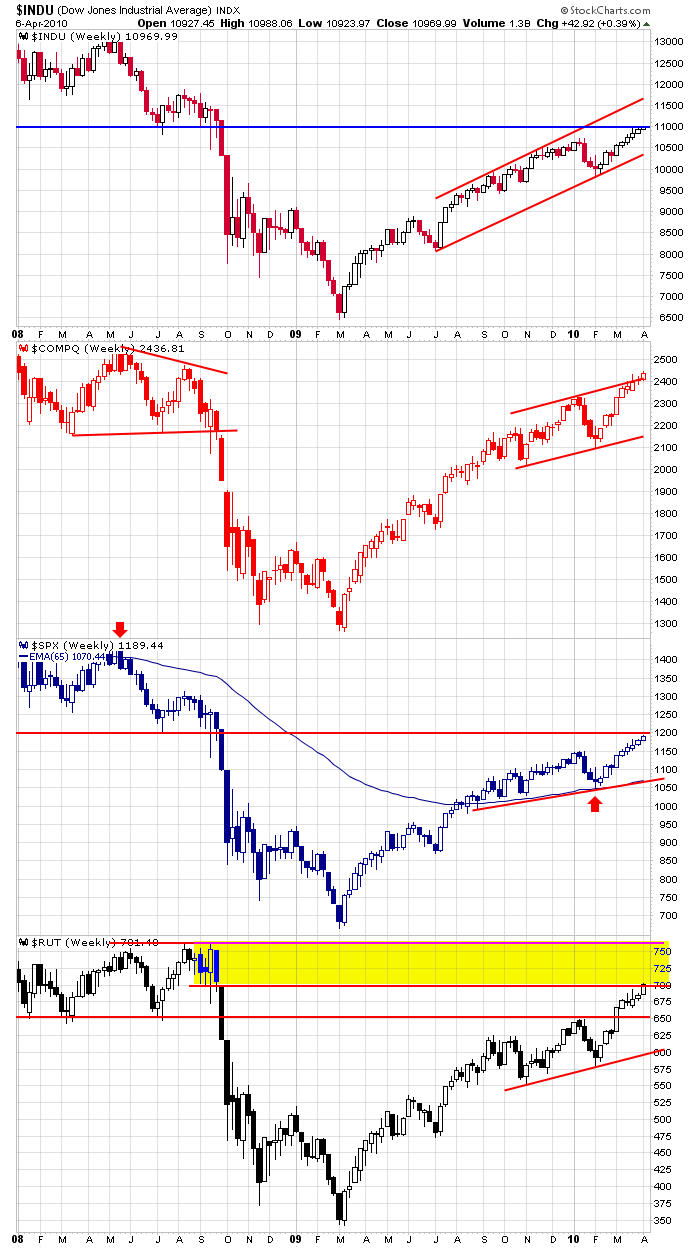

But it is noteworthy the Dow closed 30 points below resistance at 11,000; the S&P closed 10 points below 1200; and the Russell closed just above 700. Here are the weekly charts. Yes this is a logical place to pullback, but the market isn’t logical.

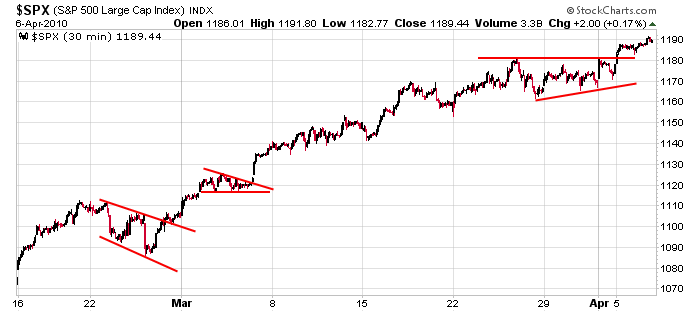

Zooming in a little via the 30-min SPX chart, I see nothing wrong with the current state of things. The trend up since the Feb low remains solidly in place, and while a pullback could come at any time, I don’t see anything that would suggest a pullback will be the beginning of a leg down.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 7)”

Leave a Reply

You must be logged in to post a comment.

Either way? My work says up into Mid May, then some top dancing, followed by a declining fall period. As you usual, good to read the analysis.

When was the market logical? Mr.Market has always rewarded those who had bet against what appeared to be “logical” to majority.